Environmental Remediation Market

P

2024

Environmental Remediation Market Size, Share, Competitive Landscape and Trend Analysis Report, by Side Type, by Medium by Technology by Application : Global Opportunity Analysis and Industry Forecast, 2024-2033

Environmental Remediation Market Research, 2033

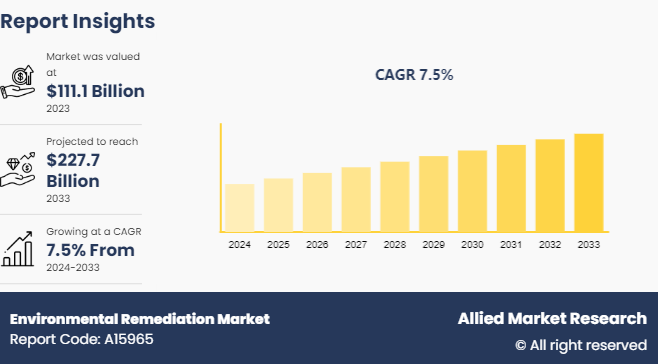

The global environmental remediation market was valued at $111.1 billion in 2023, and is projected to reach $227.7 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033.

Environmental remediation refers to the process of removing pollutants or contaminants from environmental media such as soil, groundwater, sediment, or surface water to restore or protect the environment. This process aims to reduce the risks to human health and the ecosystem caused by hazardous substances, often resulting from industrial activities, accidents, or natural disasters. Techniques include physical removal, chemical treatment, bioremediation, and containment. The choice of method depends on the type and extent of contamination. Remediation is critical in areas such as former industrial sites, landfills, and oil spills, ensuring safe land use, preserving biodiversity, and complying with environmental regulations. Increasing awareness of environmental issues has driven demand for remediation services globally.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The environmental remediation market is fragmented in nature among prominent companies such as Bristol Industries, LLC, DEME, In-Situ Oxidative Technologies, Inc., Sequoia Environmental Remediation Inc., AECOM, ENTACT, Clean Harbors Inc., HDR, Inc., Qed Environmental Systems Ltd, Tarmac International Inc.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, and LAMEA regions.

- Latest trends in global environmental remediation market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3, 300 environmental remediation industry-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global environmental remediation market.

Key Market Dynamics

Government regulations and policies play a critical role in driving the environmental remediation market. Stringent environmental laws, such as the U.S. Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) , also known as Superfund, mandate the cleanup of contaminated sites. Similar regulations exist worldwide, including the European Union’s Environmental Liability Directive (ELD) and China’s Soil Pollution Prevention and Control Action Plan. Governments are increasingly setting aside funds for remediation projects; for example, the U.S. government allocated over $1.2 billion for Superfund site cleanups in 2023. Additionally, the growing focus on sustainable development goals (SDGs) is encouraging countries to adopt more stringent environmental protection measures, thus boosting the environmental remediation market growth.

Furthermore, the rapid pace of industrialization and urbanization, particularly in emerging economies, is a significant driver of the environmental remediation market. As industries expand, so does the potential for environmental contamination due to improper waste disposal, accidental spills, and emissions. Urban expansion often leads to the development of former industrial sites, known as brownfields, which require extensive remediation before they can be repurposed for residential or commercial use. In India, for instance, industrialization has led to increased soil and groundwater contamination, prompting the government to invest in remediation projects. The rise of brownfield redevelopment initiatives in urban areas also contributes to market growth, as cities aim to reclaim contaminated land to address housing shortages and infrastructure development needs.

However, one of the primary restraints in the environmental remediation market is the high cost associated with cleanup projects. Remediation activities often require substantial financial investment, particularly for large-scale or highly contaminated sites. Costs can include site assessments, the implementation of remediation technologies, long-term monitoring, and compliance with regulatory standards. For instance, the cost of cleaning up a Superfund site in the U.S. can range from millions to billions of dollars, depending on the severity of the contamination. These high costs can be a significant deterrent for companies, especially smaller enterprises, that may lack the financial resources to undertake comprehensive remediation efforts. Additionally, government funding for remediation projects is often limited, which can delay necessary cleanups or result in incomplete remediation, leaving residual risks. The financial burden is further exacerbated by the uncertain return on investment (ROI) from these projects, making it difficult for businesses to justify the expenditure.

On the contrary, sustainability is becoming a central theme in the environmental remediation market, leading to the growth of "green remediation" practices. These practices aim to reduce the environmental footprint of remediation activities by using renewable energy sources, minimizing waste generation, and enhancing ecosystem services. Governments and industries are increasingly adopting green remediation techniques as part of their commitment to sustainability and climate goals. For instance, the U.S. EPA's Green Remediation Program encourages the use of sustainable technologies and practices in the cleanup of contaminated sites. Similarly, Canada’s Green Municipal Fund supports municipalities in implementing sustainable remediation projects, providing funding and guidance on best practices. As the global focus on sustainability intensifies, the demand for green remediation services is expected to rise, offering a lucrative opportunity for companies that can provide innovative, eco-friendly solutions.

Market Segmentation

The environmental remediation market is segmented on the basis by site type, medium, technology, application, and region. By site-type, the market is classified into public and private. By medium, the market is classified into soil and groundwater. By technology, the market is classified into excavation, permeable reactive barriers, air sparging, soil washing, chemical treatment, bioremediation, and electrokinetic remediation. By application, the market is segmented into mining and forestry, oil and gas, agriculture, automotive, landfills and waste disposal sites, industrial, construction and land development, and others. Region-wise, the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The environmental remediation market size in the Asia-Pacific (APAC) region is driven by rapid industrialization, urbanization, and stringent government regulations. Countries like China, India, and Japan are experiencing significant environmental challenges due to decades of industrial growth, leading to widespread soil and water contamination. For instance, China's Soil Pollution Prevention and Control Action Plan, launched in 2016, mandates the cleanup of contaminated land, with the government allocating over $30 billion for remediation efforts under the 13th Five-Year Plan. Similarly, India’s National Clean Air Program (NCAP) and various state-level policies are pushing for the remediation of polluted sites to mitigate the adverse effects of industrial pollution on public health and the environment.

Another major driver is the increasing focus on sustainable development and environmental protection across the region. Governments are investing heavily in green technologies and sustainable remediation practices. Japan, for example, has implemented the Soil Contamination Countermeasures Act, which requires site owners to remediate contaminated land to prevent public health risks. The rise of urban redevelopment projects, especially on brownfield sites, also contributes to the growing demand for remediation services in APAC, as countries strive to balance economic growth with environmental sustainability.

Competitive Landscape

The major players operating in the environmental remediation agent include Bristol Industries, LLC, DEME, In-Situ Oxidative Technologies, Inc., Sequoia Environmental Remediation Inc., AECOM, ENTACT, Clean Harbors Inc., HDR, Inc., Qed Environmental Systems Ltd, Tarmac International Inc.

Industry Trends

- The environmental remediation market has seen several significant trends in recent years, driven by heightened environmental awareness, regulatory pressures, and technological advancements. One key trend is the growing emphasis on sustainable and green remediation practices. Governments and industries are increasingly adopting methods that minimize the environmental impact of remediation activities. The U.S. Environmental Protection Agency (EPA) , for instance, has been promoting green remediation strategies through its Green Remediation Program, which encourages the use of renewable energy, waste reduction, and conservation of natural resources during cleanup projects. This shift towards sustainability is also evident in Europe, where the European Union’s Horizon Europe program is funding research into eco-friendly remediation technologies that reduce carbon footprints and enhance ecosystem services.

- Another notable trend is the increasing government investment in large-scale remediation projects, particularly in response to legacy pollution issues. In the United States, the Bipartisan Infrastructure Law passed in 2021 earmarked $21 billion for environmental remediation, focusing on Superfund sites, brownfields, abandoned mines, and orphaned oil wells. This represents one of the most significant federal investments in environmental cleanup in decades. Similarly, China’s government has been aggressively funding remediation efforts under its Soil Pollution Prevention and Control Action Plan, with over $30 billion allocated to clean up contaminated land as part of the country’s broader environmental protection goals. These investments reflect a global recognition of the need to address environmental contamination for public health and economic development.

- Technological innovation is also driving changes in the environmental remediation market. Advancements in remediation technologies, such as bioremediation, phytoremediation, and nanotechnology, are making cleanup efforts more effective and cost-efficient. For example, the use of nanomaterials in soil and groundwater remediation has shown promise in degrading persistent pollutants that are otherwise difficult to remove. Additionally, the integration of digital tools such as Geographic Information Systems (GIS) , remote sensing, and artificial intelligence (AI) is improving the accuracy of site assessments and the efficiency of remediation planning. Governments and private sectors are increasingly supporting research and development in these areas. The European Union, for instance, has invested heavily in developing new technologies through various funding programs, recognizing the role of innovation in achieving its environmental and climate goals. As these technologies mature, they are expected to play an increasingly critical role in global remediation efforts.

Government Policies Promoting Environmental Remediation Market

- In the U.S., Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) (Superfund) - 42 U.S.C. 9601 et seq commonly known as the Superfund law, was enacted in 1980 to address hazardous waste sites. It empowers the Environmental Protection Agency (EPA) to clean up contaminated sites and hold responsible parties accountable for the costs. The Superfund program has led to the cleanup of thousands of sites across the country.

- Brownfields Revitalization and Environmental Restoration Act of 2001 - Public Law 107-118 supports the cleanup and redevelopment of brownfield sites through financial assistance, including grants and revolving loan funds. It aims to encourage the reuse of contaminated properties, reducing urban sprawl and improving environmental quality.

- Additionally, Resource Conservation and Recovery Act (RCRA) - 42 U.S.C. 6901 et seq. governs the management of hazardous waste, including its treatment, storage, and disposal. It includes provisions for the remediation of hazardous waste sites, particularly those related to current or former industrial facilities.

- In Canada, Federal Contaminated Sites Action Plan (FCSAP) is a long-term program aimed at assessing and remediating contaminated sites under federal jurisdiction. The program provides funding to federal departments, agencies, and Crown corporations to manage their contaminated sites. Since its inception, FCSAP has funded the remediation of over 23, 000 sites across Canada.

- Furthermore, Canadian Environmental Protection Act (CEPA) - S.C. 1999, c. 33 is a comprehensive environmental law that provides the legal framework for managing pollutants, including those that contaminate soil, water, and air. The Act gives the federal government authority to regulate hazardous substances and enforce cleanup activities.

- Moreover, Ontario Brownfields Regulation - Ontario Regulation 153/04 establishes the rules for the assessment and cleanup of brownfield sites in Ontario. It includes requirements for site assessments, risk assessments, and cleanup standards, promoting the safe redevelopment of contaminated land.

- In Europe, the European Union Environmental Liability Directive (ELD) - Directive 2004/35/CE establishes a framework for preventing and remedying environmental damage, including damage to soil, water, and biodiversity. It holds operators of certain activities strictly liable for the costs of remediation if their actions cause environmental harm. The directive applies to all EU member states and has driven significant remediation activities across Europe.

- Furthermore, European Union Water Framework Directive (WFD) - Directive 2000/60/EC aims to protect and restore clean water across Europe, including the remediation of contaminated water bodies. It requires member states to achieve "good status" for all waters by a set deadline, which often involves significant remediation efforts for polluted rivers, lakes, and groundwater.

- In China, China's Soil Pollution Prevention and Control Action Plan policy outlines China's strategy for addressing soil pollution, including remediation of contaminated sites. It sets specific targets for reducing soil pollution and establishes a framework for monitoring, prevention, and remediation. The plan has spurred significant investments in soil remediation across the country.

- In Japan, Soil Contamination Countermeasures Act - Act No. 53 of 2002 provides the legal framework for identifying and remediating contaminated land in Japan. It requires site owners to investigate and report soil contamination and mandates remediation if certain pollution thresholds are exceeded. The Act has been a key driver of remediation activities in Japan.

Key Sources Referred

- National Promotion and Facilitation Agency

- United States Bureau of Statistics

- U.S. Development Authority

- United States Environmental Protection Agency

- Invest In India

- Press Information Bureau

Key Benefits For Stakeholders

- This environmental remediation market forecast provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the environmental remediation market analysis from 2024 to 2033 to identify the prevailing environmental remediation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the environmental remediation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global environmental remediation market share.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global environmental remediation market trends, key players, market segments, application areas, and market growth strategies.

Environmental Remediation Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2033 | USD 227.7 Billion |

Growth Rate | CAGR of 7.5% |

Forecast period | 2024 - 2033 |

Report Pages | 380 |

By Side Type |

|

By Medium |

|

By Technology |

|

By Application |

|

By Region |

|

Key Market Players | In-Situ Oxidative Technologies, Inc., HDR, Inc., Bristol Industries, LLC, Qed Environmental Systems Ltd, Clean Harbors Inc., Tarmac International Inc, Sequoia Environmental Remediation Inc., DEME, AECOM, ENTACT |

Related Tags

Remediation Water Treatment Hazardous WasteFrequently Asked Questions?

Increasing industrialization and urbanization and rising occurrence of natural and man-made disasters are the upcoming trends of environmental remediation market in the globe.

Oil and gas is the leading application of environmental remediation market.

Asia-Pacific is the largest regional market for environmental remediation.

The global environmental remediation market was valued at $111.1 billion in 2023, and is projected to reach $227.7 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033.

Bristol Industries, LLC, DEME, In-Situ Oxidative Technologies, Inc., Sequoia Environmental Remediation Inc., AECOM, ENTACT, Clean Harbors Inc., HDR, Inc., Qed Environmental Systems Ltd, and Tarmac International Inc are the top companies to hold the market share in environmental remediation market.