Data Center Switch Market

P

2022

Data Center Switch Market Size, Share, Competitive Landscape and Trend Analysis Report, by End User, by Product Type, by Port Speed, by Switch Type : Global Opportunity Analysis and Industry Forecast, 2021-2031

Data Center Switch Market Statistics - 2031

The global data center switch market was valued at $13.8 billion in 2021 and is projected to reach $24.6 billion by 2031, growing at a CAGR of 5.9% from 2021 to 2031.

A data center is a premise of networked computers and storage that organizations from various fields use to organize, process, store, and disseminate massive amounts of data. A business usually depends heavily on the applications, services, and data contained within a data center, making it the point of focus and a vital asset for day-to-day activities.

The global data center switch industry holds high potential for the semiconductor industry. The business scenario witnesses an increase in demand for switch data center security, particularly in developing regions, such as China, India, and others. Companies in this industry have been adopting various innovative techniques to provide customers with advanced and innovative product offerings. Factors such as growth in cloud computing, surge in edge computing, and rise in government regulations regarding localization of data centers fuel the growth of the data center switch market size. However, the high operational cost of data centers is expected to hamper the data center switch market growth. Furthermore, an increase in smart computing devices is expected to offer lucrative data center switch market opportunities for market expansion. However, high operational costs of data centers. Hence, the need for such high costs associated with data center switches may hamper the growth of the market. Furthermore, increase in smart computing devices. A rise in the adoption of IoT & cloud computing is expected to drive the integration of the chips in the data center servers, which is expected to provide a lucrative growth opportunity for the global data center switch market.

Key Takeaways

- The global market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literature, industry releases, annual reports, and other such documents of major market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Segment Overview

The data center switch market outlook is segmented into end user, product type, port speed, and switch type.

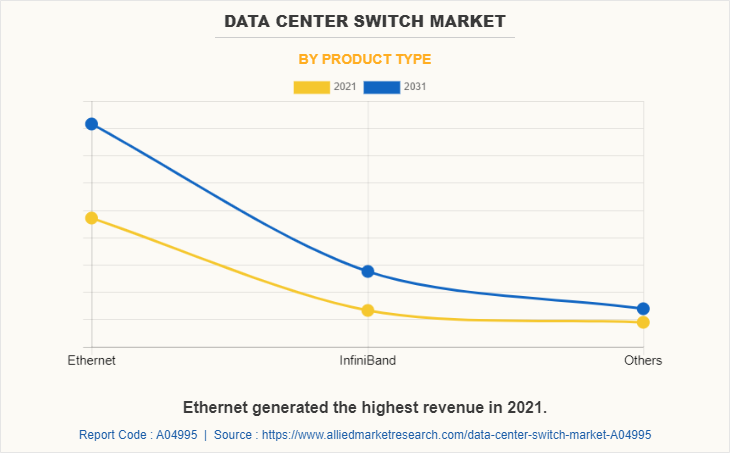

By product type, it is divided into Ethernet, InfiniBand, and others. The ethernet segment generated the largest revenue in 2021. The infiniband segment dominated the market, in terms of revenue, in 2021, and is expected to follow the same trend during the forecast period.

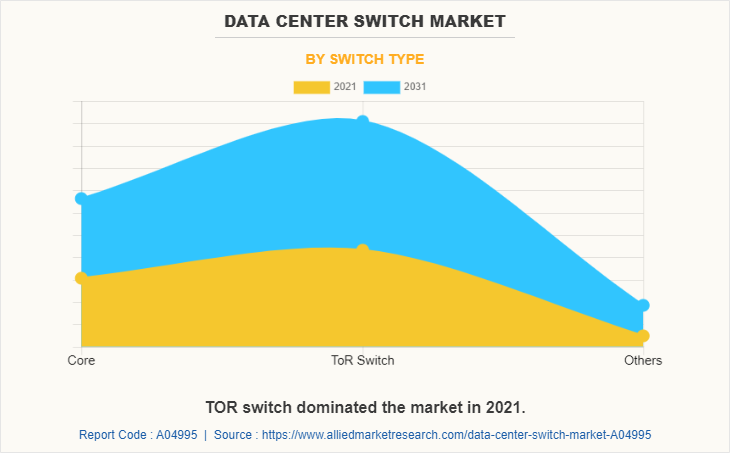

By switch type, it is categorized into the core, ToR switch, and others. ToR switch accounted for the significant data center switch market share in 2021.

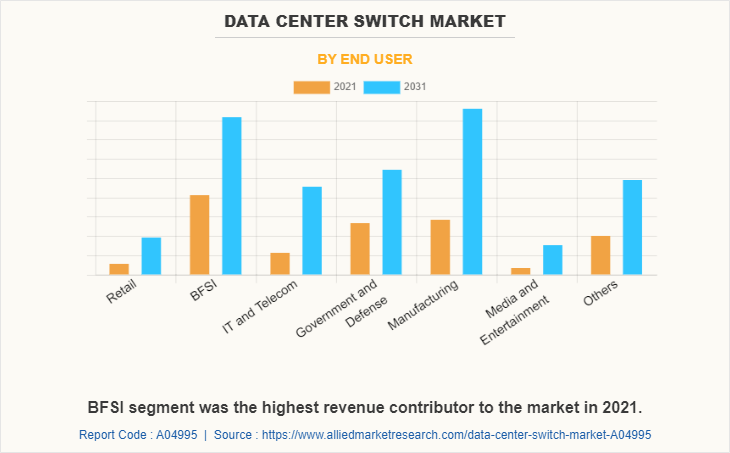

By end user, it is classified into IT & telecom, government & defense, BFSI, retail, manufacturing, media and entertainment, and others. The BFSI segment is anticipated to lead the market in 2021.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA along with their prominent countries. North America, specifically the U.S., remains a significant participant in the global data center switch industry. Major organizations and government institutions in the country are intensely putting resources into these data center switches.

Key Market Dynamics

The data center switch market is expected to witness notable growth during the forecast period, owing to the augmented demand for cloud & edge computing services. Furthermore, government regulations regarding the localization of data centers drive the growth of the market. Moreover, an increase in demand for high-speed connectivity is expected to propel the growth of the data center switch market during the forecast period.

However, rapid technological changes and concerns about data center switch systems are some of the prime factors that restrain market growth. On the contrary, the expansion of hyperscale data centers is expected to provide lucrative opportunities for the growth of the data center switch market during the forecast period.

Regional/Country Market Outlook

- North America: North America holds a significant share of the data center switch market, primarily driven by technological advancements and a high concentration of data centers. The United States, particularly Silicon Valley, is home to major tech giants like Google, Amazon, and Microsoft, which continually invest in infrastructure to enhance their cloud services. The increasing demand for efficient data management solutions, coupled with the growth of artificial intelligence and machine learning applications, propels the adoption of high-performance data center switches. Additionally, Canada is experiencing growth in its data center market, driven by investments in renewable energy sources and stringent data security regulations.

- Europe: Europe is experiencing substantial growth in the data center switch market, with countries such as Germany, the United Kingdom, and France leading the charge. The region is characterized by a strong emphasis on energy efficiency and sustainability, driving investments in modern data center infrastructure. The European Union's initiatives to promote digitalization and enhance cybersecurity are further encouraging the adoption of advanced networking solutions. As businesses migrate to cloud-based services and prioritize data protection, the demand for reliable and high-capacity switches continues to rise, positioning Europe as a key player in the global data center landscape.

- Asia-Pacific: The Asia-Pacific region dominates the data center switch market due to rapid digital transformation and increasing data consumption. Countries like China, Japan, and India are at the forefront, with significant investments in cloud infrastructure and advanced technologies. China's ambitious initiatives, such as the "Made in China 2025" plan, promote the development of data centers and AI-driven applications. Japan's focus on IoT and smart cities enhances the demand for efficient networking solutions, while India's growing IT sector and increasing internet penetration further contribute to market growth. This dynamic environment solidifies Asia-Pacific's leadership in the data center switch market.

- LAMEA: The Latin America, Middle East, and Africa (LAMEA) region is gradually emerging in the data center switch market, driven by increasing internet penetration and digital transformation initiatives. Countries such as Brazil and Mexico in Latin America are witnessing significant investments in data center infrastructure to support the growing demand for cloud services. In the Middle East, the United Arab Emirates is investing heavily in smart city projects and digital transformation, enhancing the need for efficient data management solutions. Meanwhile, Africa is seeing growth in data centers driven by increased mobile connectivity and investments in technology, presenting opportunities for data center switch providers to expand in these developing markets.

Top Impacting Factors

Significant factors impacting the data center switch market trends include a rise in cloud computing, growth in edge computing, and an increase in government regulations regarding the localization of data centers. However, high data center operational cost restricts growth up to a certain level. Furthermore, the increase in smart computing devices provides lucrative opportunities for market growth.

Competition Analysis

The key players profiled in this report include Arista Networks, Jupiter Networks, Huawei, Dell EMC, Mellanox, Cisco, Extreme Networks, Hewlett Packard Enterprise, Ericsson, and ZTE. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, regional expansion, and collaborations to enhance their market penetration.

Report Coverage & Deliverables

This report delivers in-depth insights into the data center switch market, by switch type, port speed, product type, end-user, region, and key strategies employed by major players. It offers detailed market forecasts and emerging trends.

Switch type Insights

Core switches serve as the backbone of data center networks, ensuring high-speed data transmission and optimal performance across various segments. They manage significant traffic efficiently, maintaining seamless connectivity in large-scale operations. Top-of-Rack (ToR) switches, installed within data center racks, connect servers directly to the network, optimizing space and reducing latency. Additionally, aggregation and distribution switches play crucial roles in managing data traffic and enhancing connectivity between core and edge devices. By balancing loads and optimizing data transfer paths, these switches contribute to a structured, high-performing network environment.

Port speed Insight

The 10G port speed is a widely adopted standard in data centers, offering sufficient bandwidth for various applications while ensuring lower latency and improved network performance. The increasingly popular 25G speed strikes a balance between performance and cost, ideal for organizations seeking higher bandwidth without major infrastructure upgrades. The 40G speed is designed for data-intensive applications, enhancing connectivity for efficient data transfers. The 100G speed meets the demands of large-scale data centers, supporting rapid data access. Meanwhile, the 400G speed caters to emerging technologies like AI and big data. Lower speeds, such as 1G and 2.5G, remain relevant for specific use cases.

Product type Insight

Ethernet switches lead the data center switch market due to their versatility, cost-effectiveness, and compatibility with various devices, ensuring reliable connectivity for diverse applications. InfiniBand switches cater to high-performance computing with low-latency and high-throughput capabilities, ideal for rapid data transfers in scientific research and big data analytics. Additionally, specialized switches address niche market needs, providing unique features and protocols to optimize networks for specific tasks and enhance overall data management.

End User Insight

Data center switches are critical across various sectors, enhancing operational efficiency and connectivity. In retail, they manage point-of-sale systems and inventory tracking. The BFSI sector relies on them for secure transactions and regulatory compliance. IT and telecom companies use these switches to support data processing and communication services. Government and defense organizations depend on them for secure networks, while manufacturers utilize them for automation and supply chain management. Additionally, the media and entertainment industry leverages high-bandwidth capabilities for streaming, and other sectors like healthcare and education benefit from improved data management and communication.

Regional Insights

The Asia-Pacific region dominates the data center switch market due to several key factors, including rapid digital transformation, increasing data consumption, and significant investments in cloud infrastructure. Countries like China, Japan, and India are leading the charge with substantial infrastructure development and technological advancements. The growing adoption of artificial intelligence and the Internet of Things (IoT) further drive demand for robust data center solutions. Additionally, the region's large-scale enterprises and the rising trend of remote work fuel the need for efficient data management and connectivity, solidifying Asia-Pacific's leadership in the market.

Key Strategies and Developments

- In June 2023, Cisco announced its initiative to develop an advanced software console that integrates access to all its on-premises and cloud-based network management platforms. This innovative solution aims to provide predictive analytics and enhanced visibility across various network domains, enabling organizations to optimize their network performance and streamline management processes.

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the data center switch market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall data center switch market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The data center switch market forecast is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the data center switch.

- The report includes the share of key vendors and market trends.

Data Center Switch Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2031 | USD 24.6 billion |

Growth Rate | CAGR of 5.9% |

Forecast period | 2021 - 2031 |

Report Pages | 316 |

By End User |

|

By Product Type |

|

By Port Speed |

|

By Switch Type |

|

By Region |

|

Key Market Players | Huawei Technologies Co., Ltd., Arista Networks, Inc., Cisco Systems, Inc., Hewlett Packard Enterprise (HPE), DELL EMC (DELL TECHNOLOGIES), NVIDIA Corporation (Mellanox Technologies Ltd.), Juniper Networks, Inc., Super Micro Computer, Inc., Extreme Networks, Inc, Lenovo Group |

Analyst Review

The global data center switch market is expected to leverage high potential for the manufacturing and BFSI industry verticals during the forecast period. The current business scenario is witnessing an increase in demand for data centers, particularly in developing regions such as China, India, and others, owing to increase in government mandates related to public safety and security. Companies in this industry are adopting various innovative techniques such as mergers and acquisition activities to strengthen their business position in the competitive matrix.

The major factor that drives growth of the data center switch market across Asia-Pacific is the immense digital needs of emerging economies with high populations in countries such as such as China, India, and Indonesia. In addition, high complexities in IT infrastructure, owing to virtualization and consolidation with various constraints are encouraging organizations to opt for third-party data center services. Moreover, industry verticals such as Banking, Financial Services, and Insurance (BFSI) is expected to be an integral part of the data center switch market.

Core switch types in data center are highly available, fast, and fault tolerant switches that connect to aggregate switches within a network. These switches are positioned within the backbone or physical core of a network. Core switches may not be required in small networks; however, they are indispensable in larger networks. Data center core switches are fully manageable and ideally support different methods of management including command line interface, web-based management, and SNMP management. Key data center switch market leaders profiled in the report include Arista Networks, Jupiter Networks, Huawei, Dell EMC, Mellanox, Cisco, Extreme Networks, Hewlett Packard Enterprise, Ericsson, and ZTE.

Related Tags

Transistors ICs Electronic Devices Electronic Devices Electronic devices and components Substrate-based ElectronicsFrequently Asked Questions?

North America is accounted for the largest regional market, organizations and government institutions in the country are intensely putting resources into these data center switches.

The data center switch market is estimated to grow at a CAGR of 5.92% from 2021-2031.

BFSI segment is the leading end-user in data center switch market.

The global data center switch market was valued at $13,811.6 million in 2021.

Arista networks, Huawai technologies, Juniper networks are some of the top companies to hold the market share in data center switch.