Cytogenetics Market

P

2024

Cytogenetics Market Size, Share, Competitive Landscape and Trend Analysis Report, by Product, by Technique, by Application, by End User : Global Opportunity Analysis and Industry Forecast, 2024-2035

Cytogenetics Market Research, 2035

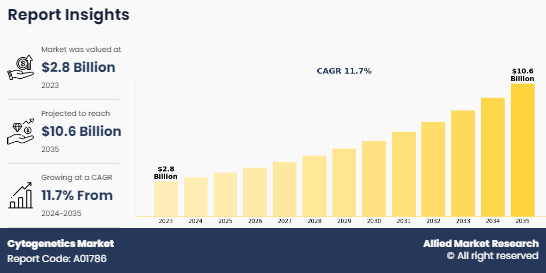

The global cytogenetics market size was valued at $2.8 billion in 2023, and is projected to reach $10.6 billion by 2035, growing at a CAGR of 11.7% from 2024 to 2035. The cytogenetics market expansion is driven by the rise in prevalence of genetic disorders & cancers, increase in demand for personalized medicine, and advancements in molecular techniques. Cytogenetics is the branch of genetics focused on studying the structure, function, and behavior of chromosomes. It involves analyzing the number, shape, and arrangement of chromosomes to detect genetic abnormalities, such as those causing developmental disorders, cancers, or congenital conditions. Techniques such as karyotyping, fluorescence in situ hybridization (FISH), and comparative genomic hybridization (CGH) are commonly used in cytogenetics. This field plays a critical role in diagnosing genetic diseases, guiding treatment decisions, and advancing personalized medicine.

Key Takeaways

- By product, the consumable segment dominated the global market in terms of revenue in 2023. However, the software and service segment is expected to register the highest CAGR during the forecast period.

- By application, the cancer segment dominated the global market in terms of revenue in 2023. However, the personalized medicine segment is expected to register the highest CAGR during the forecast period.

- By technique, the comparative genome hybridization segment dominated the global cytogenetics market share in 2023 is expected to register the highest CAGR of 12.7% during the forecast period

- By end user, the clinical and research laboratory segment dominated the market in terms of revenue in 2023. However, the pharmaceutical and biotechnology company segment is expected to register the highest CAGR during the forecast period.

- By region, North America dominated the cytogenetics market share in terms of revenue in 2023. However, Asia-Pacific is expected to register the highest CAGR during the forecast period.

Market Dynamics

According to cytogenetics market forecast analysis increase in prevalence of genetic disorders and cancers amplifies the need for advanced diagnostic techniques. With the rise in prevalence of these conditions, healthcare systems are focusing on early diagnosis and personalized treatment, making cytogenetic testing essential. In addition, advancements in molecular biology, particularly in technologies such as fluorescence in situ hybridization (FISH), comparative genomic hybridization (CGH), and next-generation sequencing (NGS), have significantly improved the precision and efficiency of cytogenetic analysis, driving cytogenetics market growth. These innovations enable faster, more accurate detection of chromosomal abnormalities, providing critical insights into various genetic diseases and cancer diagnostics, thus boosting the demand for cytogenetic services in clinical and research settings. Furthermore, the rise in awareness of personalized medicine, which modifies treatments based on individual genetic profiles, propels the adoption of cytogenetic tests.

In addition, according to cytogenetics market opportunity analysis, personalized medicine has become increasingly important in fields such as oncology, where cytogenetic analysis helps identify genetic mutations and chromosomal alterations that guide targeted therapies, improving patient outcomes. The integration of cytogenetics into prenatal diagnostics is another significant driver for market growth. Pregnant women are increasingly opting for non-invasive prenatal testing (NIPT) and other cytogenetic methods to detect chromosomal abnormalities in fetuses, such as Down syndrome and other aneuploidies, further fueling cytogenetics market growth.

However, the high cost of advanced cytogenetic testing and equipment limits access, particularly in developing regions with less robust healthcare infrastructures is expected to negetively impact growth of cytogenetics market size. In addition, the complexity of cytogenetic procedures requires highly skilled professionals for accurate interpretation, and a shortage of such expertise hinders widespread adoption.

However, regulatory approvals and favorable government initiatives support genetic testing through policies and programs aimed at improving public health outcomes, which provides market growth. This led to the establishment of more genetic testing centers and laboratories, particularly in developed regions such as North America and Europe, where healthcare infrastructure is robust.

Segments Overview

The cytogenetics market is segmented into product, technique, application, end user, and region. By product, it is classified into consumable, instrument, and software & service. The consumables segment is further classified into testing kits & reagents, media, probes, and others. Media segment further includes serum media and others. By technique, the market is divided into comparative genome hybridization, fluorescence in situ hybridization, karyotyping, and others. The karyotyping segment is further categorized into prenatal testing, cancer, and others. Prenatal testing segment is fragmented into consumable, instrument, and software & services. Cancer segment further categorized into consumables which includes testing kits and reagents and media. The others segment is divided into consumables, which include testing kits and reagents & media.

By application, it is segmented into genetic disorders, cancer, personalized medicine, and others. By end user, the market is classified into clinical & research laboratory, pharmaceutical & biotechnology company, academic research institute, and others. The clinical research laboratory segment further includes cancer research, clinical diagnostics labs, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, LAMEA.

By Product

The consumable segment dominated the market share in 2023 due to surge in demand for consumable products such as reagents, dyes, and kits used in cytogenetic testing and analysis. In addition, the rise in the number of genetic tests performed, advancements in cytogenetic technologies, and the increasing use of these consumables in clinical laboratories and research institutions drove their significant market share.

However, the software & service segment is expected to register the highest CAGR during the forecast period. This is attributed to the increase in adoption of advanced software solutions for data analysis and management. Innovations in bioinformatics, cloud-based platforms, and automated systems are enhancing the efficiency and accuracy of cytogenetic testing, leading to greater demand for these solutions.

By Technique

The comparative genome hybridization segment dominated the global cytogenetics market share in 2023 is expected to register the highest CAGR of 12.7% during the forecast period, owing to the technology's superior ability to detect genomic alterations with high resolution and accuracy. CGH provides a comprehensive overview of chromosomal imbalances, such as duplications and deletions, which are crucial for diagnosing genetic disorders and cancers.

By Application

The cancer segment dominated the global cytogenetics market share in 2023, owing to the high prevalence of various cancers and the critical role cytogenetic testing plays in their diagnosis and treatment. However, the personalized medicine segment is expected to register the highest CAGR during the forecast period. This is attributed to the increase in focus on tailoring treatments based on individual genetic profiles, which relies heavily on advanced cytogenetic technologies. Personalized medicine enhances the efficacy of treatments by targeting specific genetic mutations and chromosomal abnormalities, leading to more precise and effective therapeutic strategies.

By End User

The clinical and research laboratory segment held the largest market share in 2023, owing to high demand for cytogenetic testing in both clinical diagnostics and research applications. Clinical laboratories utilize cytogenetic tests for diagnosing genetic disorders, cancers, and prenatal conditions, which drives substantial market demand.

However, the pharmaceutical and biotechnology company clinics segment is expected to register the highest CAGR during the forecast period, owing to increase in integration of cytogenetic technologies in drug development and personalized medicine. These companies leverage cytogenetic testing to identify genetic biomarkers, optimize clinical trials, and develop targeted therapies tailored to specific genetic profiles.

By Region

By region, the cytogenetics industry is analyzed across North America, Europe, Asia-Pacific, LAMEA. North America accounted for the largest share in the cytogenetics market in 2023. This dominance is attributed to the region's well-established healthcare infrastructure, high adoption of advanced cytogenetic technologies, and significant investment in R&D. In addition, the growing prevalence of genetic disorders and cancers, along with an increasing focus on personalized medicine, driven demand for cytogenetic testing in clinical and research settings.

However, the Asia-Pacific region is anticipated to register the highest CAGR during the forecast period. This is attributed to increase in healthcare investments, expanding medical infrastructure, and growing awareness of genetic disorders and cancer diagnostics. The rise in demand for personalized medicine, coupled with advancements in cytogenetic technologies, is driving the adoption of cytogenetic testing in countries such as China, India, and Japan.

Competitive Analysis

Key players such as Precipio, Inc. and Applied Spectral Imaging have adopted product launch and partnership as key developmental strategies to improve the product portfolio of the cytogenetics market. For instance, in July 2024, Applied Spectral Imaging announced the release of GenASIs Version 8.4, packed with new features to bring more efficiency to lab workflows and with more automation, integration, interoperability and accessibility.

Recent Developments in the Cytogenetics Industry

- In May 2024, Thermo Fisher Scientific Inc. announced that the Applied Biosystems CytoScan Dx Assay and Applied Biosystems Chromosomal Analysis Suite (ChAS) Dx software now comply with In Vitro Diagnostic Regulations (IVDR) 2017/746 in the European Union. These compliance updates are expected to enable cytogenetics testing laboratories to adapt to the latest medical device safety and efficacy frameworks and conformity assessments.

- In February 2024, Motic Digital Pathology, a Whole Slide Image (WSI) digital scanner company and international leader in deployments for cancer diagnosis announced an expanded Joint-Venture relationship with Applied Spectral Imaging (ASI) to create integrative end-to end solutions for AI-enabled analysis of H&E, IHC and FISH samples—from image to diagnosis.

- In January 2024, Barco, and Applied Spectral Imaging (ASI), a world leader in advanced biomedical imaging with a comprehensive product portfolio for karyotyping, H&E, IHC and FISH imaging and analysis, announced a new commercial partnership to offer best-in-class digital solutions for pathology laboratories.

- In January 2024, Precipio, Inc. announced that it has entered into an agreement with a Japanese distributor for the sales and distribution of its products into the Japanese market. The distributor has already secured its first purchase order from a leading Japanese clinical laboratory, for Precipio’s proprietary IV-Cell cytogenetics media.

- In December 2023, Applied Spectral Imaging announced collaboration with the CytoCell division of OGT, a Sysmex Group company, and a global leader in diagnostic genomic solutions. This partnership expands global reach and adds value to customers in Cytogenetics laboratories

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cytogenetics market analysis from 2023 to 2035 to identify the prevailing cytogenetics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cytogenetics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cytogenetics market trends, key players, market segments, application areas, and market growth strategies.

Cytogenetics Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2035 | USD 10.6 billion |

Growth Rate | CAGR of 11.7% |

Forecast period | 2023 - 2035 |

Report Pages | 322 |

By Product |

|

By Technique |

|

By Application |

|

By End User |

|

By Region |

|

Key Market Players | AddLife, PAN-Biotech, Capricorn Scientific, Precipio, Inc., Applied Spectral Imaging, Thermo Fisher Scientific Inc. |

Analyst Review

This section provides various opinions of top-level CXOs in the cytogenetics market. According to the insights of CXOs, the cytogenetics market is driven by an increase in prevalence of genetic disorders and cancers, which heightens the demand for advanced diagnostic tools. In addition, rises in advancements in technology and the growing emphasis on personalized medicine enhance the adoption of cytogenetic techniques. CXOs further added that surge in prevalence of genetic disorders and congenital abnormalities heightens the demand for advanced diagnostic tools. In addition, increase in government and private sector investments in genetic research and healthcare infrastructure are propelling market growth. Furthermore, investments in healthcare infrastructure and research further propel market growth.

North America generated the largest revenue in 2023, owing to efforts taken by government and pharmaceutical companies towards the spread of awareness related to genetic disorders. In addition, the rise in prevalence of genetic disorders and presence of most of the major key players in this region contribute towards the growth of the market. However, Asia-Pacific is expected to register the highest CAGR during the forecast period, owing to an increase in healthcare investments, and rising awareness of advanced diagnostic technologies. The region's expanding healthcare infrastructure, growing prevalence of genetic disorders, and rising demand for personalized medicine further contribute to the robust growth of the cytogenetics market

Related Tags

CytogeneticsFrequently Asked Questions?

The total market value of cytogenetics market is $2.8 billion in 2023.

The forecast period for cytogenetics market is 2024 to 2035.

The market value of cytogenetics market in 2035 is $10.6 billion.

North America is accounted for the largest market share in 2023. This is attributed to its advanced healthcare infrastructure, high adoption of innovative technologies, and significant investments in research and development.

The base year is 2023 in cytogenetics market.

The growth of the cytogenetics market is driven by the rise in prevalence of genetic disorders and cancers, increasing demand for personalized medicine and targeted therapies, and advancements in cytogenetic technologies and research.

Cytogenetics is the branch of genetics that studies the structure and function of chromosomes. It involves analyzing chromosomal abnormalities and genetic mutations to diagnose and understand genetic disorders and diseases.