Cystic Fibrosis (CF) Therapeutics Market

P

2025

Cystic Fibrosis (CF) Therapeutics Market Size, Share, Competitive Landscape and Trend Analysis Report, by Drug class, by Route of administration : Global Opportunity Analysis and Industry Forecast, 2025-2034

Cystic Fibrosis (CF) Therapeutics Market Research, 2034

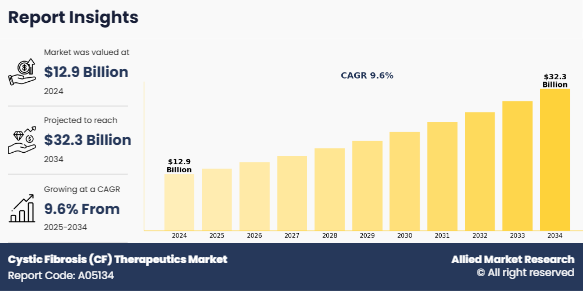

The global cystic fibrosis therapeutics market size was valued at $12.9 billion in 2024, and is projected to reach $32.3 billion by 2034, growing at a CAGR of 9.6% from 2025 to 2034. The cystic fibrosis therapeutics market growth is driven by advancements in gene therapy, rise in awareness about early diagnosis & treatment, and expansion of clinical trials. For instance, in January 2024, the Cystic Fibrosis Foundation announced an investment of up to $5 million in Clarametyx Biosciences to support the development of CMTX-101, a novel anti-bacterial therapy targeting biofilms that protect bacteria from antibiotics.This therapy aims to enhance the effectiveness of existing treatments for chronic infections caused by Pseudomonas aeruginosa, a major contributor to lung infections in individuals with cystic fibrosis. The investment is expected to fund a Phase 1b/2a clinical trial evaluating CMTX101 in combination with inhaled tobramycin.

Cystic fibrosis (CF) is a hereditary disorder that affects the lungs, digestive system, and other organs, caused by mutations in the CFTR (Cystic Fibrosis Transmembrane Conductance Regulator) gene. This mutation leads to the production of thick, sticky mucus that clogs airways and traps bacteria, resulting in chronic infections, lung damage, and complications in other parts of the body. CF therapeutics refers to the range of treatments and medical interventions developed to manage, treat, or correct the underlying causes and symptoms of the disease.

Key Takeaways

- On the basis of drug class, the CFTR modulators segment dominated the global cystic fibrosis therapeutics market share in 2024. However, the others segment is anticipated to be the fastest-growing segment during the forecast period.

- On the basis of route of administration, the oral segment dominated the global cystic fibrosis therapeutics market size in 2024. However, the inhaled segment is anticipated to be the fastest-growing segment during the forecast period.

- Region-wise, North America dominated the market in terms of revenue in 2024. However, Asia-Pacific is anticipated to grow at the highest CAGR during the cystic fibrosis therapeutics market forecast period.

Market Dynamics

The cystic fibrosis therapeutics market growth is driven by continuous advancements in drug development, prevalence of cystic fibrosis, and rise in awareness about early diagnosis & treatment options. In addition, rise in technological innovations, especially in the development of CFTR modulators, have revolutionized the management of the disease by addressing its root cause rather than just alleviating symptoms. The introduction of highly effective therapies, such as triple-combination drugs, has contributed to remarkable improvements in patient outcomes, thereby boosting market expansion.

Government initiatives and funding support for rare disease research have further accelerated the development and approval of novel therapeutics. In addition, strong collaboration between research organizations, pharmaceutical companies, and patient advocacy groups has led to a robust pipeline of potential therapies currently in various stages of clinical trials. The growing emphasis on personalized medicine, along with advancements in genetic screening, is enabling targeted treatments tailored to individual genetic mutations, enhancing treatment efficacy and expanding the patient pool eligible for advanced therapies.

Moreover, increasing investments from pharmaceutical giants and rising healthcare expenditure globally are strengthening the market landscape. For instance, in November 2024, the Cystic Fibrosis Foundation announced an investment of up to $15 million in ReCode Therapeutics to advance a gene editing therapy for cystic fibrosis (CF). This initiative, in collaboration with Intellia Therapeutics, focuses on correcting specific CFTR gene mutations, particularly those not addressed by existing CFTR modulators. ReCode is developing specialized lipid nanoparticles designed to deliver gene editing components directly to lung stem cells, aiming for a durable therapeutic effect. This funding is part of the Foundation's broader "Path to a Cure" initiative, supporting innovative treatments for all individuals with CF. Strategic alliances, licensing agreements, and mergers among key players are helping to bring innovative therapies to the market faster.

In addition, expanding newborn screening programs in various countries are facilitating earlier diagnosis, allowing timely initiation of treatment and better disease management. The overall shift toward more proactive and preventive healthcare approaches is expected to sustain the growth momentum of the CF therapeutics market. With ongoing research in gene editing technologies such as CRISPR, the future holds potential for even more transformative solutions, promising better outcomes for patients with cystic fibrosis.

However, the high cost of treatment, particularly CFTR modulators, restricts market growth. This financial burden makes therapies inaccessible for many individuals, especially in low- and middle-income countries, where healthcare coverage and reimbursement policies are limited. In addition, the stringent regulatory approval processes for novel therapies present obstacles, as developing and bringing a new CF drug to market requires extensive clinical trials, substantial investment, and significant time, which restrains market growth.

On the other hand, rapidly advancing gene editing and gene therapy approaches such as CRISPR/Cas9–based corrective treatments offer the potential for onetime, mutation specific cures that address the root cause of CF rather than managing its symptoms which provides an opportunity for the market growth.

Segmental Overview

The cystic fibrosis therapeutics industry is segmented on the basis of drug class, route of administration, and region. By drug class, the market is classified into pancreatic enzyme supplements, mucolytic, CFTR modulators, and others. By route of administration, the market is classified into oral and inhaled.

Region wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, and rest of Europe), Asia-Pacific (Japan, China, India, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and Rest of LAMEA).

By Drug Class

The CFTR modulators segment dominated the cystic fibrosis (CF) therapeutics market share in 2024. This is attributed to their ability to target the underlying cause of the disease rather than just managing symptoms. These therapies have shown significant improvements in lung function, quality of life, and overall patient outcomes. Increasing approvals of next-generation modulators further supported the segment’s robust growth.

However, the others segment is expected to register the highest CAGR during the forecast period. This is attributed to an expanding pipeline of bronchodilator and anti-infective therapies that enhance airway clearance while directly targeting chronic pulmonary infections. The rising prevalence of drug-resistant bacterial strains in CF lungs, coupled with favorable regulatory pathways for inhaled adjunctive treatments, further fuels this segment’s rapid growth.

By Route of administration

The oral segment dominated the market in terms of revenue in 2024, attributed to the ease of administration, improved patient compliance, and the widespread adoption of oral CFTR modulators. The convenience of at-home treatment and the reduced need for hospital visits further strengthened the segment’s growth.

However, the inhaled segment is expected to register the highest CAGR during the forecast period. This is attributed to its effectiveness in delivering medications directly to the lungs, resulting in faster action and improved respiratory outcomes. The rising adoption of inhaled antibiotics and mucolytics for managing pulmonary infections in cystic fibrosis patients further supports this growth.

By Region

The cystic fibrosis (CF) therapeutics market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in terms of revenue in 2024. This is attributed to its well-established healthcare infrastructure and extensive newborn screening programs that enable early diagnosis. High reimbursement rates and favorable payer policies have accelerated patient access to premium CFTR modulators and adjunct therapies. In addition, the strong presence of leading pharmaceutical companies and substantial R&D investments in the region have driven rapid commercialization of innovative CF treatments.

Asia-Pacific is expected to grow at the highest rate during the forecast period owing to rapid improvements in healthcare infrastructure and diagnostic capabilities, the expansion of newborn screening and patient registries that boost CF diagnosis rates, increasing government support and favorable reimbursement policies for rare-disease therapies, and growing collaborations between local biotech firms and global CF drug developers.

Competition Analysis

Major key players that operate in the global CF therapeutics market are A Teva Pharmaceutical Industries Ltd., Viatris Inc., Vertex Pharmaceuticals Incorporated, AbbVie Inc., F. Hoffmann-La Roche Ltd., Gilead Sciences, Inc., Lupin, Chiesi Farmaceutici S.p.A., Digestive Care, Inc., and GSK plc. Key players operating in the market have adopted product approval, agreement, and clinical trial as their key strategies to expand their product portfolio.

Recent Developments in the Cystic Fibrosis Therapeutics Industry

- In April 2025, Vertex Pharmaceuticals announced that the European Commission has granted regulatory approval for a label expansion of KAFTRIO (ivacaftor/tezacaftor/elexacaftor) in a combination regimen with ivacaftor for the treatment of people with cystic fibrosis (CF). With this approval, the indication has been expanded to include all patients ages 2 years and older who have at least one non-class I mutation in the cystic fibrosis conductance regulator (CFTR) gene.

- In March 2025, Vertex Pharmaceuticals announced that the United Kingdom (UK) Medicines and Healthcare products Regulatory Agency (MHRA) has granted approval for ALYFTREK (deutivacaftor/tezacaftor/vanzacaftor), a once-daily next-in-class triple combination cystic fibrosis transmembrane conductance regulator (CFTR) modulator treatment for people living with cystic fibrosis (CF) ages 6 years and older who have at least one F508del mutation or another responsive mutation in the CFTR gene.

- In January 2025, Global pharma major Lupin Limited (Lupin) announced that it has received tentative approval from the United States Food and Drug Administration (U.S. FDA) for its Abbreviated New Drug Application for Ivacaftor Oral Granules, 25 mg, 50 mg, and 75 mg per unit dose packet, to market a generic equivalent of Kalydeco® Oral Granules, 25 mg, 50 mg, and 75 mg, of Vertex Pharmaceuticals Incorporated. Lupin is the exclusive first-to-file for this product and is expected to be eligible for 180 days of generic drug exclusivity. This product would be manufactured at Lupin’s Nagpur facility in India.

- In December 2024, Vertex Pharmaceuticals Incorporated announced that the U.S. Food and Drug Administration (FDA) has approved ALYFTREK (vanzacaftor/tezacaftor/deutivacaftor), a once-daily next-in-class triple combination cystic fibrosis transmembrane conductance regulator (CFTR) modulator for the treatment of cystic fibrosis (CF) in people 6 years and older who have at least one F508del mutation or another mutation in the CFTR gene that is responsive to ALYFTREK. See below for Important Safety Information, including a Boxed Warning.

- In December 2024, Vertex Pharmaceuticals Incorporated announced the U.S. Food and Drug Administration (FDA) approved the expanded use of TRIKAFTA (elexacaftor/tezacaftor/ivacaftor and ivacaftor) for the treatment of people with cystic fibrosis (CF) ages 2 and older who have at least one F508del mutation in the cystic fibrosis transmembrane conductance regulator (CFTR) gene or a mutation that is responsive to TRIKAFTA based on clinical and/or in vitro data.

- In September 2024, Vertex Pharmaceuticals has announced significant advancements in cystic fibrosis (CF) treatment, highlighting Phase 3 clinical data for its investigational triple combination therapy,vanzacaftor/tezacaftor/deutivacaftor (referred to as the "vanza triple"), and new long-term data on TRIKAFTA.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cystic fibrosis therapeutics market analysis from 2024 to 2034 to identify the prevailing cystic fibrosis therapeutics market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cystic fibrosis (cf) therapeutics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cystic fibrosis therapeutics market trends, key players, market segments, application areas, and market growth strategies.

Cystic Fibrosis (CF) Therapeutics Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2034 | USD 32.3 billion |

Growth Rate | CAGR of 9.6% |

Forecast period | 2024 - 2034 |

Report Pages | 254 |

By Drug class |

|

By Route of administration |

|

By Region |

|

Key Market Players | AbbVie Inc., Lupin, GSK plc., Chiesi Farmaceutici S.p.A., Viatris Inc., Digestive Care, Inc., F. Hoffmann-La Roche Ltd., Vertex Pharmaceuticals Incorporated, Gilead Sciences, Inc., Teva Pharmaceutical Industries Ltd. |

Related Tags

Cystic Fibrosis TherapeuticsC Therapeutics Pancreatic Enzyme Supplements Mucolytic CFTR modulatorsFrequently Asked Questions?

The total market value of cystic fibrosis (CF) therapeutics market was $12.9 billion in 2024.

The forecast period for cystic fibrosis (CF) therapeutics market is 2025 to 2034.

The market value of cystic fibrosis (CF) therapeutics market is projected to reach $32.3 billion by 2034.

The base year is 2024 in cystic fibrosis (CF) therapeutics market .

Top company including Vertex Pharmaceuticals Incorporated held a high market position in 2024.

The growth of the cystic fibrosis (CF) therapeutics market is driven by prevalence of CF and advancements in personalized medicine. Rising awareness and early genetic screening have enabled timely diagnosis and treatment.

Cystic fibrosis (CF) therapeutics refer to the range of treatments and drugs used to manage and treat cystic fibrosis, a genetic disorder that affects the lungs, pancreas, and other organs by causing thick, sticky mucus buildup.