Crude Oil Market

P

2024

Crude Oil Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Composition by Extraction Process by End Use : Global Opportunity Analysis and Industry Forecast, 2024-2033

Crude Oil Market Research, 2033

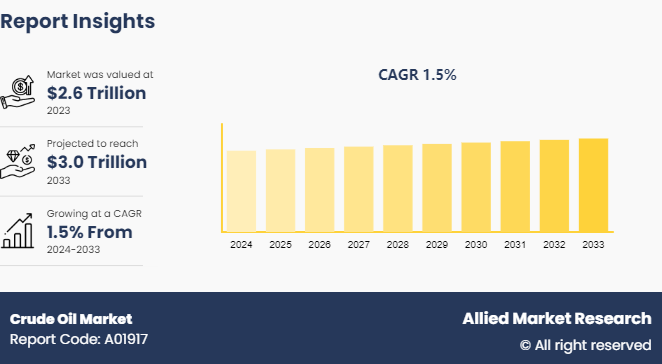

The global crude oil market size was valued at $2.6 trillion in 2023, and is projected to reach $3.0 trillion by 2033, growing at a CAGR of 1.5% from 2024 to 2033.

Market Introduction and Definition

Crude oil, also known as oil, is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. It is extracted from underground reservoirs through drilling and is then refined into various products, including gasoline, diesel, jet fuel, heating oil, and numerous petrochemicals used to produce plastics, fertilizers, and pharmaceuticals. The refining process involves separating and converting the different hydrocarbons into usable products through distillation and other chemical processes.

Key Takeaways

- The crude oil market report study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major crude oil industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

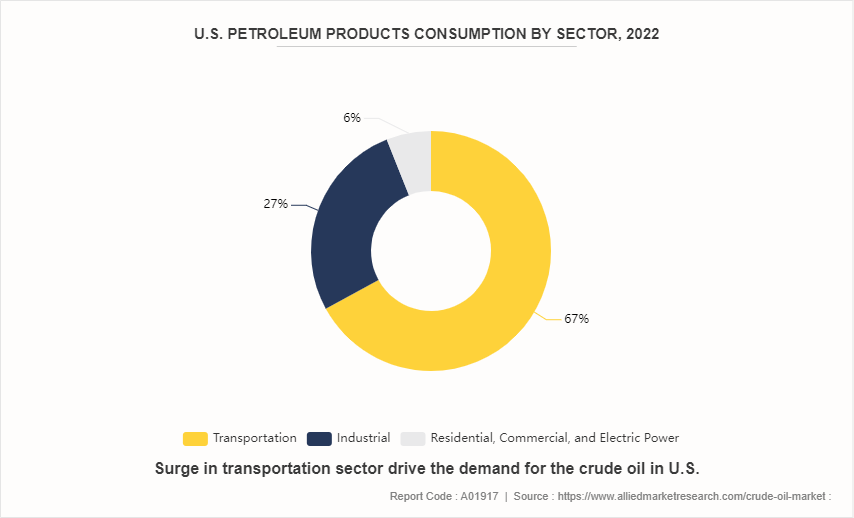

The expansion of transportation infrastructure globally has fueled demand for crude oil. Cars, trucks, ships, and airplanes continue to heavily rely on petroleum-based fuels, propelling the need for crude oil extraction and refining. This dependency is unlikely to diminish soon, as alternative energy sources such as electric vehicles are still in the early stages of adoption and face infrastructure challenges. According to the Internation Energy Agency (IEA) , the Oil 2023 medium-term market report forecasts that based on current government policies and market trends, global oil demand is expected to rise by 6% between 2022 and 2028 to reach 105.7 million barrels per day (mb/d) which is supported by robust demand from the petrochemical and aviation sectors. All these factors are expected to drive the growth of the crude oil market during the forecast period.

However, inconsistent government regulations across different countries hamper the demand for crude oil. Regulatory frameworks governing the oil industry vary widely, often creating uncertainty and instability in the market. For instance, some countries implement stringent environmental regulations aimed at reducing carbon emissions, which leads to decreased investment in oil exploration and production. Furthermore, fluctuating subsidies and tax incentives disrupt the oil market. All these factors hamper the crude oil market growth.

Technological advancements have improved the efficiency and environmental footprint of oil extraction. Enhanced oil recovery (EOR) techniques, such as carbon dioxide injection and thermal recovery, enable producers to extract a higher percentage of oil from existing fields. This maximizes the output from mature fields, delaying their decline and reducing the need for new drilling sites. Furthermore, advancements in digital technology such as the use of big data analytics, artificial intelligence, and the Internet of Things (IoT) , have optimized drilling operations, maintenance schedules, and production processes. These innovations lead to cost savings and reduce environmental impact by minimizing waste and lowering emissions. All these factors are anticipated to offer new growth opportunities in the global crude oil market forecast.

Pricing Analysis of Crude Oil

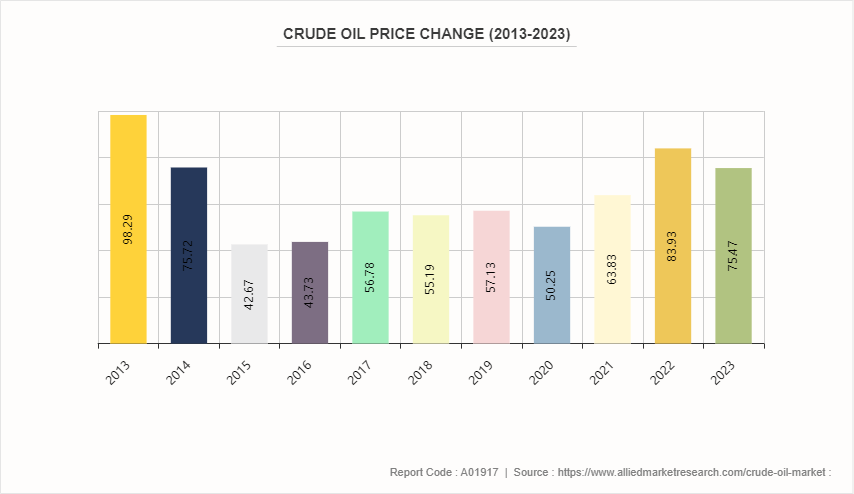

The sharp decline from $98.29 in 2013 to $42.67 in 2015 and the subsequent years of relatively low prices prompted many oil companies to cut costs, streamline operations, and delay or cancel major projects. These price fluctuations also influenced global market dynamics, with lower prices benefiting consumers and industries dependent on oil, while challenging oil-exporting countries and companies reliant on higher prices for profitability. The recovery in prices starting in 2021, reaching $83.93 in 2022, indicates a rebound in demand post-pandemic, though ongoing fluctuations continue to pose strategic challenges for producers, pushing them towards technological innovations and diversification into renewable energy sources to ensure long-term.

Market Segmentation

The crude oil market is segmented into type, extraction process, composition, end use and region. By type, the market is classified into very light oil, light oil, medium oil, and heavy fuel oil. By extraction process, the market is bifurcated into conventional and unconventional. By composition, the market is divided into hydrocarbon compounds, non-hydrocarbon compounds, inorganic salts, and others. By end use, the market is classified into transportation, industrial, residential, commercial, and power generation. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the crude oil market overview include Saudi Arabian Oil Co., National Iranian Oil Company (NIOC) , Exxon Mobil Corporation, China National Petroleum Corporation, bp p.l.c., Royal Dutch Shell, Chevron Corporation, KUWAIT PETROLEUM CORPORATION, TotalEnergies, and Petrobras.

Regional Industry Outlook

The U.S. is one of the largest producers and consumers of crude oil, plays a significant role in this balance. In addition, the shale revolution has increased North American oil production, particularly in the U.S. and Canada. Advances in hydraulic fracturing and horizontal drilling have unlocked vast reserves of oil from shale formations, leading to a surge in output. Moreover, industrial output, transportation needs, and overall economic growth drive the demand for crude oil. In North America, factors such as vehicle miles traveled, airline traffic, and industrial production indices are closely watched indicators of oil demand. In addition, seasonal variations such as higher gasoline consumption during summer driving months and increased heating oil demand in winter, also impact crude oil prices.

- The development of hydraulic fracturing (fracking) and horizontal drilling techniques has unlocked vast reserves of shale oil, particularly in the U.S. Regions such as the Permian Basin in Texas and New Mexico, the Bakken Formation in North Dakota, and the Eagle Ford Shale in Texas have become major centers of oil production.

- North America, particularly the U.S. and Canada has witnessed increasing regulatory scrutiny regarding environmental impacts. Policies aimed at reducing carbon emissions and promoting cleaner energy sources are influencing the crude oil industry. This includes stricter emissions standards, incentives for renewable energy development, and efforts to reduce methane leaks from oil and gas operations.

- Advances in technology play a critical role in the oil industry. Innovations in drilling techniques, data analytics, and automation are improving efficiency and reducing costs. Moreover, enhanced oil recovery (EOR) methods are also being developed to maximize extraction from existing fields.

Industry Trends

- Crude oil prices have experienced significant volatility due to geopolitical tensions, supply-demand imbalances, economic conditions, and policy decisions by major oil-producing countries such as OPEC and Russia.

- Increase in environmental concerns and regulations have pushed for cleaner energy sources, impacting the demand outlook for crude oil. This includes policies promoting electric vehicles and renewable energy adoption, which potentially reduce long-term oil demand growth.

- Technological innovations in exploration, drilling, and extraction techniques have improved efficiency and reduced costs in the oil industry. This has particularly benefited shale oil production that makes it more competitive.

- The global shift toward cleaner energy sources and efforts to mitigate climate change are shaping long-term demand expectations for crude oil. This transition includes investments in renewable energy, energy efficiency measures, and the development of alternative fuels.

Key Sources Referred

- International Trade Administration

- Organization of the Petroleum Exporting Countries

- Internation Energy Agency

- U.S. Energy Information Administration (EIA)

- Organisation for Economic Co-operation and Development

- Petroleum Planning & Analysis Cell

- Joint Organisations Data Initiative

- International Association of Oil & Gas Producers

- The Institute for Oil and Gas Sector

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the crude oil market analysis from 2024 to 2033 to identify the prevailing crude oil market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the crude oil market forecast and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their crude oil market share.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global crude oil market trends, key players, market segments, application areas, and market growth strategies.

Crude Oil Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2033 | USD 3.0 Trillion |

Growth Rate | CAGR of 1.5% |

Forecast period | 2024 - 2033 |

Report Pages | 420 |

By Type |

|

By Composition |

|

By Extraction Process |

|

By End Use |

|

By Region |

|

Key Market Players | bp p.l.c., Chevron Corporation, National Iranian Oil Company (NIOC), Saudi Arabian Oil Co., TotalEnergies, Exxon Mobil Corporation, China National Petroleum Corporation, Royal Dutch Shell, Petrobras, KUWAIT PETROLEUM CORPORATION |

Related Tags

Crude Oil Market Crude Oil IndustryFrequently Asked Questions?

The global crude oil market was valued at $2.6 trillion in 2023, and is projected to reach $3.0 trillion by 2033, growing at a CAGR of 1.5% from 2024 to 2033.

North America is the largest regional market for Crude Oil.

Transportation is the leading application of Crude Oil Market.

Technological advancements in extraction is the upcoming trends of Crude Oil Market in the globe.

The major players operating in the crude oil market include Saudi Arabian Oil Co., National Iranian Oil Company (NIOC), Exxon Mobil Corporation, China National Petroleum Corporation, bp p.l.c., Royal Dutch Shell, Chevron Corporation, KUWAIT PETROLEUM CORPORATION, TotalEnergies, and Petrobras.