Cross border Payments Market

P

2025

Cross border Payments Market Size, Share, Competitive Landscape and Trend Analysis Report, by Transaction Type, by Enterprise Size, by Channel : Global Opportunity Analysis and Industry Forecast, 2025-2034

Cross Border Payments Market Research, 2034

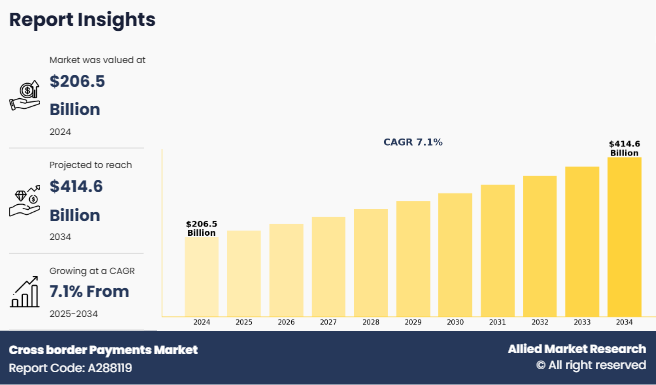

The global cross border payments market was valued at $206.5 billion in 2024, and is projected to reach $414.6 billion by 2034, growing at a CAGR of 7.1% from 2025 to 2034. Cross border payments encompass the financial infrastructure, technologies, and institutions that enable the seamless transfer of funds across international borders. These transactions involve multiple currencies, banking systems, and regulatory frameworks, making the market complex and dynamic. Cross border payments facilitate global trade, e-commerce, remittances, and investments, supporting businesses, financial institutions, and individuals worldwide.

The cross border payments market includes various payment methods such as bank wire transfers, international card transactions, electronic fund transfers, and digital wallets. Traditional players like SWIFT (Society for Worldwide Interbank Financial Telecommunication), correspondent banking networks, and financial institutions dominate the sector, but new entrants, including fintech companies, blockchain-based solutions, and payment service providers, are reshaping the competitive landscape. The growing adoption of real-time payments (RTP), SWIFT transfers, blockchain, and central bank digital currencies (CBDCs) is transforming the efficiency, speed, and cost-effectiveness of cross-border transactions. The cross border payments market is influenced by regulatory frameworks such as anti-money laundering (AML) laws, know your customer (KYC) requirements, and data protection policies. Different jurisdictions impose varying levels of compliance, making interoperability and regulatory adherence critical challenges for industry players. Governments and international organizations, such as the financial action task force (FATF) and the Bank for International Settlements (BIS), play a key role in influencing policies to enhance security and transparency and growing the fintech solutions.

Key Takeaways:

-

By transaction type, the business to business (B2B) segment accounted for the largest cross border payments market share in 2024.

-

By enterprise size, the large enterprise segment accounted for the largest cross border payments market in 2024.

-

By channel, the bank transfer segment accounted for the largest cross border payments market share in 2024.

-

Region wise, North America generated the highest revenue in 2024.

Segment review

The cross border payments market is segmented on the basis of transaction type, enterprise size, end user, channel, and region. By transaction type, market is segmented into business to business (B2B), customer to business (C2B), business to customer (B2C), and customer to customer (C2C). On the basis enterprise size, it is segmented into large enterprise size, and small and medium-sized enterprises and individual. By end user, it is bifurcated into individuals, and business and government. On the basis of channel, the cross border payments market is segmented into bank transfer, money transfer operator, card payment, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. .

On the basis of channel, the bank transfer segment attained the highest market share in 2024 in the cross border payments market. This can be attributed to the fact that banks are widely trusted for their security, reliability, and regulatory compliance. Many businesses and individuals prefer bank transfers for large transactions, trade payments, and remittances due to their established networks and ability to handle multiple currencies. Meanwhile, the others segment is projected to be the fastest-growing segment during the forecast period, owing to mobile banking and cryptocurrency options offer lower fees, faster transactions, and greater accessibility. Cryptocurrency provide a way to send money instantly across borders without relying on traditional banking infrastructure, while mobile banking solutions allow users to transfer money easily using smartphones. As more people adopt digital wallets and decentralized payment methods, this segment is set to expand rapidly, especially in developing regions and among tech-savvy users looking for faster and more affordable payment alternatives.

Region wise, North America attained the highest market share in 2024 and emerged as the leading region in the cross border payments market due to North America's open and diverse economies promote international investment and trade. The region's major banks, fintech companies, and digital payment providers facilitate fast and secure transactions is driving the growth of the market. Additionally, the widespread adoption of digital payment methods by businesses and consumers further accelerates market growth. On the other hand, LAMEA is projected to be the fastest-growing region for the cross border payments market during the cross border payments market forecast period owing to increasing digitalization, rising smartphone and internet usage, and growing e-commerce activity. Many countries in this region are adopting new financial technologies to improve cross-border transactions, and governments are supporting financial inclusion initiatives. Additionally, the increasing number of migrant workers sending remittances back home is also fueling the demand for cross border payment services and creating cross border payments market opportunity.

The report focuses on growth prospects, restraints, and analysis of the global cross border payments market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global market.

Competition Analysis:

Competitive analysis and profiles of the major players in the market are Payoneer Inc., Visa Inc., FIS, TransferMate, Adyen N.V., PayPal Holdings, Inc., Stripe, Inc., Western Union Holdings, Inc., American Express Company, PingPong Global Solutions Inc., Thunes Ltd., Brightwell Payments, Inc., UniTeller, Inc. , Banking Circle Group, MoneyGram International, Inc.. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help drive the growth of the cross border payments industry globally.

Recent Developments in the Cross border payments industry:

In August 2023, Banking Circle Group expanded its business with the launch of BC Payments, a licensed subsidiary in Australia. This initiative aims to provide Australian fintechs, payment businesses, and banks with global payment solutions, addressing cross border payment challenges and facilitating both onshore and offshore growth.

Top Impacting Factors

Digital Transformation and Fintech Innovation

Digital transformation and fintech innovation are major driving factors in the cross border payment market, revolutionizing the way international transactions are conducted. With advancements in financial technology, traditional payment barriers such as long processing times, high transaction fees, and complex banking procedures are being eliminated. Technologies like blockchain, artificial intelligence (AI), and machine learning (ML) have enhanced the speed, security, and transparency of cross border payments and payment gateways. Real-time payment systems, digital wallets, and API-driven banking solutions enable seamless fund transfers, reducing reliance on intermediaries and lowering operational costs for businesses and consumers alike. These innovations empower individuals and businesses to send and receive money internationally with greater efficiency and accessibility. Moreover, fintech companies are continuously introducing new payment solutions that cater to the evolving demands of a globalized economy. Digital-only banks, decentralized finance (DeFi) platforms, and stablecoins provide alternatives to traditional banking systems, making cross border payments more inclusive and efficient. AI-powered fraud detection and compliance tools ensure secure transactions by identifying suspicious activities in real time, reducing financial risks. Additionally, central banks and regulatory authorities are increasingly embracing digital transformation by developing central bank digital currencies (CBDCs) and enhancing cross border payment interoperability. As fintech innovation continues to accelerate, the cross border payment market is expected to become more streamlined, cost effective, and widely accessible, catering to the needs of a rapidly expanding global digital economy.

Key Benefits For Stakeholders

-

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Cross border payments market analysis from 2024 to 2034 to identify the prevailing cross border payments market opportunities.

-

The market research is offered along with information related to key drivers, restraints, and opportunities.

-

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network and cross border payments market outlook.

-

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

-

Major countries in each region are mapped according to their revenue contribution to the global market.

-

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players and cross border payments market size

-

The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and cross border payments market growth strategies.

Cross border Payments Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2034 | USD 414.6 billion |

Growth Rate | CAGR of 7.1% |

Forecast period | 2024 - 2034 |

Report Pages | 378 |

By Transaction Type |

|

By Enterprise Size |

|

By Channel |

|

By Region |

|

Key Market Players | UniTeller, Inc. , MoneyGram International, Inc., Visa Inc., Banking Circle Group, Western Union Holdings, Inc., Brightwell Payments, Inc., PingPong Global Solutions Inc., FIS, TransferMate, Payoneer Inc., PayPal Holdings, Inc., Thunes Ltd., Stripe, Inc., Adyen N.V., American Express Company |

Analyst Review

The cross border payment market is a rapidly expanding sector that facilitates international financial transactions between individuals, businesses, and financial institutions. These payments play a crucial role in global commerce, remittances, foreign investments, and digital trade. The market is characterized by a diverse range of participants, including banks, fintech companies, payment service providers, and regulatory bodies, all working to enhance the speed, security, and efficiency of international transactions. In recent years, the market has witnessed significant transformation due to technological advancements and evolving consumer demands. Traditional banking channels, which often involve high fees and slow processing times, are being challenged by fintech innovations, blockchain-based solutions, and digital wallets. The rise of real-time payment networks, artificial intelligence (AI), and decentralized finance is improving the efficiency of cross-border transactions, making them more accessible and cost-effective for businesses and individuals similarly. Governments and financial institutions implement anti-money laundering (AML), know-your-customer (KYC), and data security regulations to ensure transparency and prevent fraud. However, regulatory fragmentation across different jurisdictions challenges for seamless international transactions, prompting increased collaboration among financial authorities worldwide. The key drivers of growth in the cross border payment market include rising globalization, increasing digital financial inclusion, and the growth of e-commerce. Small and medium-sized enterprises (SMEs) are increasingly leveraging digital payment solutions to expand their reach across borders, while migrant workers continue to fuel remittance flows to developing economies. Additionally, the use of central bank digital currencies (CBDCs) and stablecoins is expected to make major changes to cross border payments by reducing the need for traditional banks. However, there are still challenges such as high transaction fees, currency fluctuations, cybersecurity threats, and difficulties in connecting different payment systems. Despite these issues, investments in better payment infrastructure, stronger regulations, and new technologies are helping to solve these problems. As digital technology and global trade continue to evolve, the cross border payment market continuous to grow and improve, making international transactions faster, cheaper, and more efficient in the future. For instance in Febuary 2023, TransferMate launched an embedded solution for cross border payment. Banks and other financial organizations can integrate with the company's worldwide payment infrastructure to create payment solutions for customers. It will make it possible for banks and other financial organizations to provide their customers with payment solutions and services that are faster and less expensive

Related Tags

Digital walletsFintech solutionsPeer-to-peerRemittance Bank Transfer Money Transfer Operator Card Payment payments Cross-border Payments ecommerceFrequently Asked Questions?

The global cross-border payment market was valued at $206.5 billion in 2024 and is projected to reach $414.6 billion by 2034, growing at a CAGR of 7.1% from 2025 to 2034.

Digital transformation and Fintech innovation, and globalization of trade and e-commerce are the upcoming trends of the Cross-border Payments Market in the globe.

Adoption of Blockchain and Cryptocurrency is the leading application of the Cross border Payments Market.

North America is the largest regional market for Cross border Payments Market.

Payoneer Inc., Visa Inc., FIS, TransferMate, Adyen N.V., PayPal Holdings, Inc., Stripe, Inc., Western Union Holdings, Inc., American Express Company, PingPong Global Solutions Inc., Thunes Ltd., Brightwell Payments, Inc., UniTeller, Inc., Banking Circle Group, MoneyGram International, Inc. are the top companies to hold the market share in Cross border Payments