Business Travel Market

P

2023

Business Travel Market Size, Share, Competitive Landscape and Trend Analysis Report, by INDUSTRY, by SERVICE, by TRAVELER : Global Opportunity Analysis and Industry Forecast, 2022-2031

Business Travel Market Research, 2031

The global business travel market size was valued at $689.7 billion in 2021, and is projected to reach $2.1 trillion by 2031, growing at a CAGR of 9.5% from 2022 to 2031.Business travel is a division of regular tourism in which people travel for a business-oriented purpose. It includes transportation, accommodation, business work, entertainment, and other activities. The global travel & tourism industry is one of the largest industries with a global economic contribution of more than $9000 billion, in 2019.

The business travel market is segmented into INDUSTRY, SERVICE and TRAVELER.

According to World Travel and Tourism Council (WTTC), the global travel & tourism sector contributed to around $5.8 trillion to the global GDP (Gross Domestic Product) in 2021. The business travel segment witnesses the highest growth rate in this industry, as employees working in multinational organizations are often required to travel across various countries for business purposes. In business tourism, destinations are commercial places, which are well-developed and suited for trade work. Travel & tourism includes leisure tourism, business tourism, medical tourism, and others. The factors that promote the growth of travel & tourism industry include changes in lifestyle, rise in tourism promotion, increase in accessibility of transport facilities, and surge in infrastructures, which in turn are expected to fuel the growth of the business travel market. Factors such as technological advancements have given rise to easy access to hotel & transport booking through online portals, which further boost market growth. Continuous development in the travel & tourism industry and integration of various segments such as hospitality & infrastructure with government initiatives accelerate the growth of global travel & tourism industry, which in turn supplements the growth of the market.

Numerous companies operating in the global business travel market are trying to provide well-managed and cost-effective programs to the customers with the rise in demand for business travel management. The growth of the global market is driven by the expansion of the travel & tourism industry, surge in government initiatives for the development of meetings, incentives, conferences, and events (MICE) segment & small and medium-sized enterprises (SMEs) sector and increase in globalization of businesses. However, surge in adoption of advanced technology such as video conferencing hampers the market growth, as it is cost-effective and less time-consuming as compared to travelling.

Market Dynamics

SMEs (small and medium-sized enterprises) play a crucial role in the development of the economy. These firms offer numerous job opportunities, and therefore they are one of the significant sectors that aid in reducing unemployment, even when large enterprises are downsizing. However, certain challenges such as weak linkage with external market and limited SME financing act as restraints in the growth of the SMEs.

To sustain the economy, governments have started taking numerous initiatives such as Udayami Helpline, Skill India, District-level Incubation and Accelerator Program in India, SME Industrial Clustering in China, and other countries to promote the growth of the SME segment. Moreover, in 2021, there were approximately 400 million SMEs across the globe that constitute 95% of the global business firms. The growth of the SMEs has significantly promoted the growth of the business travel market, as business travelers in this sector frequently travel to seek every small opportunity to expand their market size in this large industry.

Conversely, increase in infrastructural investment and rapid growth in the travel retail market are anticipated to provide lucrative opportunities for the business travel market. The outbreak of COVID-19 emerged as a major threat to the global travel & tourism industry that severely deteriorated the business travel industry. The pandemic led to cancellation of almost all the major business travel activities and MICE events across the globe.

Moreover, the wide spread penetration of online video conferencing platforms such as Zoom and Google Meet, due to travel restrictions is expected to compete with the players operating in the global business travel market in the future. The adoption of video conferencing platforms is serving the needs of many companies for meetings and conferences and is also adopted by them as a cost control measure as companies are avoiding the costly business travel expenses. In this way, COVID-19 has changed the competitive landscape of the global business travel Industry and is anticipated to have a long-term effect.

There are various technological advancements that emerged in the recent years and are being adopted by the business travel stakeholders. The popular technologies such as virtual reality, augmented reality, artificial intelligence, chat bots, voice search & voice control technology, and internet of things (IoT) are used by the players operating in the business travel market.

Voice search, chat bots are used in the websites to provide customers the convenience and ease of booking hotels and tickets. With the help of virtual reality, customers can take a 360 degree tour of the hotels, restaurants, and landscapes by sitting at the comfort of their home and decide whether to book a hotel or not. Moreover, robotics technology is also being used in hotels and restaurants. Robots can potentially be used in preparation of food and food services. Robots can be used in hotels for cleaning, luggage handling, and greeting guests that may help to attract customers. All these technologies are expected to drive the global business market in the upcoming future.

Public and private travel & tourism investment is necessary to support the ongoing growth of the sector. High investment is required to build structures and facilities to expand capacity and maintain & improve current infrastructure. However, some of the regions such as India, China, Saudi Arabia, and the UAE have witnessed a strong economic growth and notable development in business travel over the years. Thus, these countries focus on infrastructural development of roads, airports, and better hotels to cater to the demands of corporate and government travelers.

For example, Chinese government has increased its rail network to 132,000 km over the past decade. It also developed 5.9 km air route recently and has a total of 8.4 km air route network. The air passenger volume of China has now become the second largest across the globe. China has also invested heavily in developing high-speed rail system since 2008 and now China has around two-thirds of the global high-speed rail network. Therefore, rapid infrastructural development facilitates business and business tourism. These infrastructural developments has made China the leader in the market.

The primary focus of every business is to achieve profit maximization at minimum cost. High investment often generates high revenue. However, economic uncertainty along with recession has degraded the consumption rate of the market, thereby declining the sales significantly. This has changed the pattern of investments for several companies, as they have started adopting cost-cutting strategies. However, business travel is an expensive affair, as it involves transportation such as flights & taxi, food & accommodation of the traveler, and the expense is significantly higher if it is an international trip.

This issue has been overcome with the help of technological advancements. Advancement such as online banking, phone calls, emails, and video conferences have made communication and transactions significantly cost-effective and easy in real time. Moreover, the emergence of real-time communication opportunity is encouraging companies to adopt several communication technologies such as video conferencing through online platforms such as Skype, FaceTime, Google Meet, and Zoom. Low cost and high effectiveness of such technology is acting as a major restraint for the business travel market growth.

Segment Overview

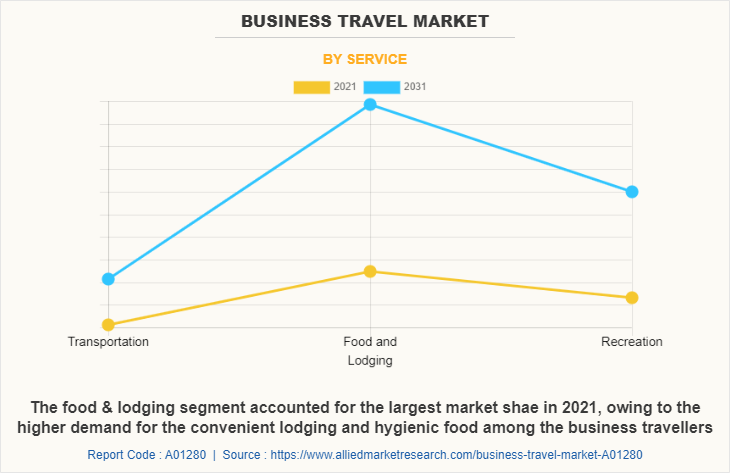

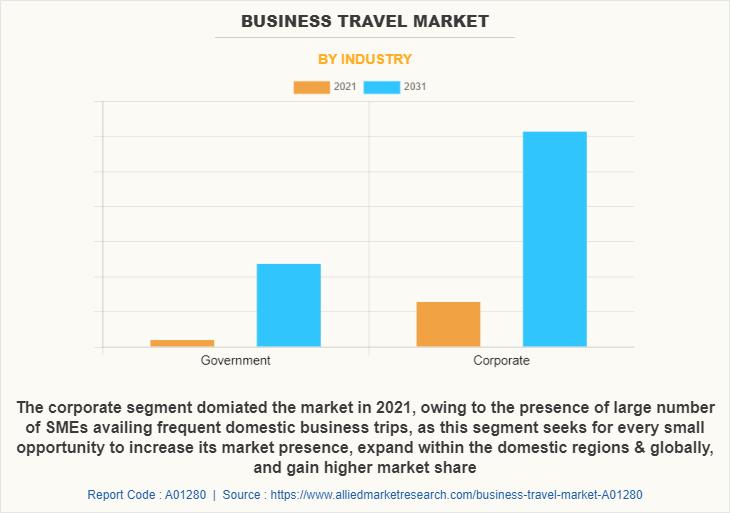

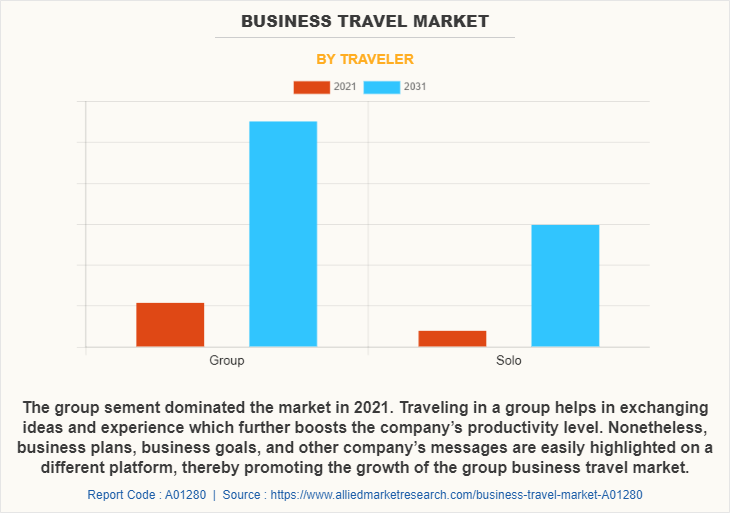

The global business travel market is segmented based on the service, industry, traveler, and region. Based on service, it is segmented into transportation, food & lodging, and recreation. Furthermore, the transportation segment is categorized into air, rail, and car. On the basis of industry, the market is segmented into government and corporate. The market, on the basis of traveler, is categorized into group and solo traveler. By region, the global market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

According to the business travel market forecast, based on service, the food & lodging segment is expected to be the fastest-growing segment, growing at a CAGR of 9.8% during the forecast period. The food & lodging was also the dominating segment, garnering around 50.4% of the business travel market share in 2021. The growing penetration of hotel booking agents such as Airbnb and Oravel Stays, are fostering the growth of the food & lodging segment.

As per the business travel market analysis, based on the industry, the corporate segment was the dominating segment and is also forecasted to be the fastest-growing segment due to growth of business activities across the globe. The corporate segment accounted for around 65.9% market share in 2021 and is expected to witness growth at the highest CAGR of 9.8% during the forecast period.

Based on traveler, the group was the largest and the fastest-growing segment that garnered 59.9% market share in 2021 and is anticipated to grow at a significant CAGR of 9.9% in the upcoming future. The group segment is prospering as the cost involved in group tourism is lower. Further, the service providers offers discounted rates on accommodation and transportation for group travel.

Regional Analysis

Based on the region, the Asia-Pacific is the largest and the fastest-growing market for business travel due to rapidly growing infrastructure, favorable conditions for setting up businesses, and government policies for attracting foreign investments. Asia-Pacific accounted for 43.7% of the market in 2021 followed by North America and Europe that constituted 26.2% and 24.2% market share respectively in 2021. LAMEA is expected to show considerable growth due to growing business activities, growing government initiatives to attract FDIs (foreign direct investments), and continuous infrastructural development in the region.

Key Market Players

The players operating in the global market have adopted various developmental strategies to expand their market share, explore the business travel market opportunities, and increase profitability in the market. The key players profiled in this report include American Express Company, BCD Group, CWT Global B.V., American Express Global Business Travel, Chase, Navan, Inc., TravelPerk S.L.U, Corporate Travel Management Limited, Flight Centre Travel Group Limited, and Citi Bank N.A.

Some Examples of partnership in the market are:

- In August 2022, BCD Group (BCD Travel) extends partnership with FairFly to offer their APA solution to the entire global customer base. Through this, BCD Travel will leverage FairFly's technology and artificial intelligence to power their air price assurance (APA) solution.

- In July 2022, BCD Group (BCD Travel) partnered with Airbus, which is an aerospace products manufacturing company in order to service four European home markets namely, France, Germany, Spain and the UK.

- In December 2022, CWT Global B.V., expanded global partnership with Paramount Global, which is multinational media and entertainment conglomerate. Through this, it will manage Paramount's expanded travel business.

Some Examples of product launches in the market are:

- In July 2022, CWT Global B.V., announced to launch car rental and train booking capabilities to the mobile and web channels on its myCWT platform.

Some Examples of acquisitions in the market are:

- In February 2020, BCD Group (BCD Travel) acquired the Ventura Spa to extend its service such as corporate travel, meetings & events and travel consolidation services.

- In July 2022, Corporate Travel Management Limited acquired 1000 Mile Travel Group Ltd, in order to expand its interest in the business travel market through independent consultant model.

- In August 2020, Flight Centre Travel Group Limited acquired WhereTo, a San Francisco-based enterprise travel platform and technology company. This development done to include artificial intelligence technology so that it helps in recommending employees hotels, flights and ground transportation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the business travel market analysis from 2021 to 2031 to identify the prevailing business travel market demand.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the business travel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the business travel market statistics of the regional as well as global business travel market trends, key players, market segments, application areas, and market growth strategies.

Business Travel Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2031 | USD 2.1 trillion |

Growth Rate | CAGR of 9.5% |

Forecast period | 2021 - 2031 |

Report Pages | 300 |

By INDUSTRY |

|

By SERVICE |

|

By TRAVELER |

|

By Region |

|

Key Market Players | American Express Global Business Travel, Citibank, N.A., TravelPerk S.L.U, Flight Centre Travel Group Limited, Chase, CWT Global B.V., American Express Company, Navan, Inc., Corporate Travel Management Limited, BCD Group |

Analyst Review

The business travel industry has witnessed steady growth even under several turbulence such as global uncertainty, weakened global economy, terrorist attacks, world health issues, and others. This is attributed to the positive impact of business travel, which has a high return on investment, and further increases the interest of top-level management of business organizations across the world to invest heavily in this market.

According to the insights of the CXOs, Asia-Pacific region is expected to grow at a significant rate during the forecast period, owing to increase in government initiatives to carry out business activities conveniently. Moreover, economic development is a prime factor in business travel, as it plays a major role in managing relationships, investments, supply chains, and logistics, which further influences trade in the domestic & international markets. Rise in trend of online booking & fund transfer has increased the convenience and lowered the cost of travel expenses, thereby offering a pleasurable experience to the travelers.

Related Tags

Travel Destinations Luxury Accommodations Travel Packages Travel Safety Travel Safety Luxury Travel Experiences Travel Planning Luxury Travel Experiences Outdoor ActivitiesFrequently Asked Questions?

The global business travel market was valued at $689.7 billion in 2021, and is expected to reach $2,095.4 billion by 2031, growing at a CAGR of 9.5% from 2022 to 2031. Business travel is a division of regular tourism in which people travel for a business-oriented purpose. It includes transportation, accommodation, business work, entertainment, and other activities. The global travel & tourism industry is one of the largest industries with a global economic contribution of more than $9000 billion, in 2019.

The business travel market report is available on request on the website of Allied Market Research.

The forecast period considered in the global business travel market report is from 2022 to 2031. The report analyzes the market sizes from 2022 to 2031 along with the upcoming market trends and opportunities. The report also covers the key strategies adopted by the key players operating in the market.

The players operating in the global business travel market have adopted various developmental strategies to expand their market share, explore the business travel market opportunity, and increase profitability in the market. The key players profiled in this report include American Express Company, BCD Group, CWT Global B.V., American Express Global Business Travel, Chase, Navan, Inc., TravelPerk S.L.U, Corporate Travel Management Limited, Flight Centre Travel Group Limited, and Citi Bank N.A.

The global business travel market is segmented based on the service, industry, traveler, and region. Based on service, it is segmented into transportation, food & lodging, and recreation. Furthermore, the transportation segment is categorized into air, rail, and car. On the basis of industry, the business travel market is segmented into government and corporate. The business travel market, on the basis of traveler, is categorized into group and solo traveler. By region, the global business travel market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on the region, the Asia-Pacific is the largest and the fastest-growing market for business travel due to rapidly growing infrastructure, favorable conditions for setting up businesses, and government policies for attracting foreign investments. Asia-Pacific accounted for 43.7% of the market in 2021 followed by North America and Europe that constituted 26.2% and 24.2% market share respectively in 2021. LAMEA is expected to show considerable growth due to growing business activities, growing government initiatives to attract FDIs (foreign direct investments), and continuous infrastructural development in the region.

Based on the region, the Asia-Pacific is the largest and the fastest-growing market for business travel due to rapidly growing infrastructure, favorable conditions for setting up businesses, and government policies for attracting foreign investments. Asia-Pacific accounted for 43.7% of the market in 2021 followed by North America and Europe that constituted 26.2% and 24.2% market share respectively in 2021. LAMEA is expected to show considerable growth due to growing business activities, growing government initiatives to attract FDIs (foreign direct investments), and continuous infrastructural development in the region.

The outbreak of COVID-19 disease resulted in the global shutdown of economic activities causing severe damage to the tourism industry. According to the Global Business Travel Association (GBTA), global business travel spending plummeted 52% in 2020 and the losses are 10 times larger than the Great Recession of 2008. Business travel spending fell by around 60% in North America, in Europe by 78%, and in Asia-Pacific by 48% in 2020. The overall global business travel spending fell by around 52% resulting in huge revenue losses for the players operating in the business travel market.