Wavelength Division Multiplexer (WDM) Market

P

2025

Wavelength Division Multiplexer (WDM) Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Industry Vertical : Global Opportunity Analysis and Industry Forecast, 2025-2034

Wavelength Division Multiplexer (WDM) Market Research, 2034

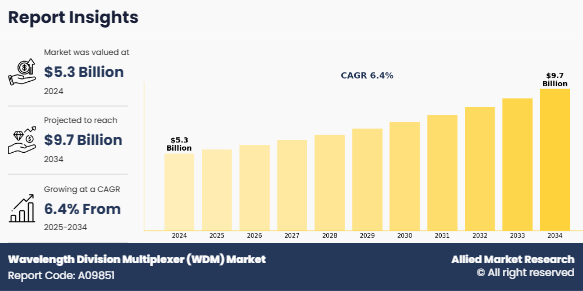

The global wavelength division multiplexer (WDM) market was valued at $5.3 billion in 2024, and is projected to reach $9.7 billion by 2034, growing at a CAGR of 6.4% from 2025 to 2034.

Wavelength division multiplexing (WDM) is a technique of multiplexing multiple optical carrier signals through a single optical fiber channel by varying the wavelengths of laser lights. WDM allows communication in both directions in the fiber cable.

Global internet users and network traffic growth at rapid rates are driving the Wavelength Division Multiplexer (WDM) market. With the growth of digital adoption, led by e-commerce, video streaming, cloud computing, and work-from-home, telecom operators are under increasing pressure to increase the capacity of their networks. Conventional networking solutions are unable to cope with this volume, but technologies such as DWDM and CWDM provide a solution for future-proof, high-speed data transmission. As governments and businesses build out fiber-optic networks, demand for effective, high-bandwidth optical communication solutions is accelerating, driving WDM use worldwide.

However, installing WDM networks needs specialized configuration, installation, and maintenance, posing difficulties for enterprises and telecom operators. Dense Wavelength Division Multiplexing (DWDM) and Coarse Wavelength Division Multiplexing (CWDM) systems demand careful calibration, skilled labor training, and sophisticated monitoring tools to ensure flawless operation. In addition, maintaining optical amplifiers, multiplexers, and transceivers can be costly and complex, particularly in multi-vendor environments.

Without optimized management and automation solutions, such complexities can become a hindrance to adoption, particularly for small service providers who do not have the technical staff and financial means to manage WDM infrastructure effectively.

Furthermore, heightened usage of Passive Optical Networks (PONs) offers enormous growth prospects to the WDM market since telecommunications service providers aim at cheap high-bandwidth broadband service. PON with WDM optimizes the utilization of fiber, offers fast data delivery at high speeds, and achieves scalable networks with expandability yet passivity to signal amplification. This comes in handy when applied in Fiber-to-the-Home (FTTH) and Fiber-to-the-Premises (FTTP) deployments, where broadband application is on the rise. Smart city projects, urbanization, and digital inclusion are fueling the need for WDM-powered PON solutions to be the next-generation solution for scalable optical networks.

Segmental Analysis

The Wavelength Division Multiplexer (WDM) Market Share is segmented into type, industry vertical, and region.

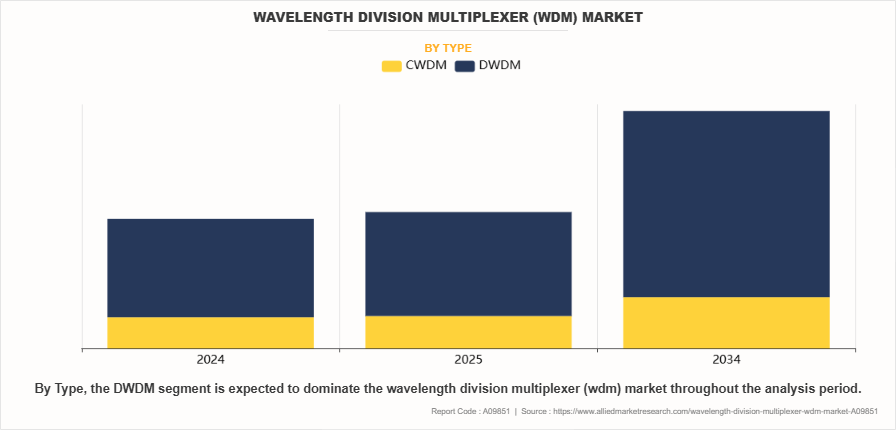

By type, the Wavelength Division Multiplexer (WDM) Industry is bifurcated into CWDM and DWDM.

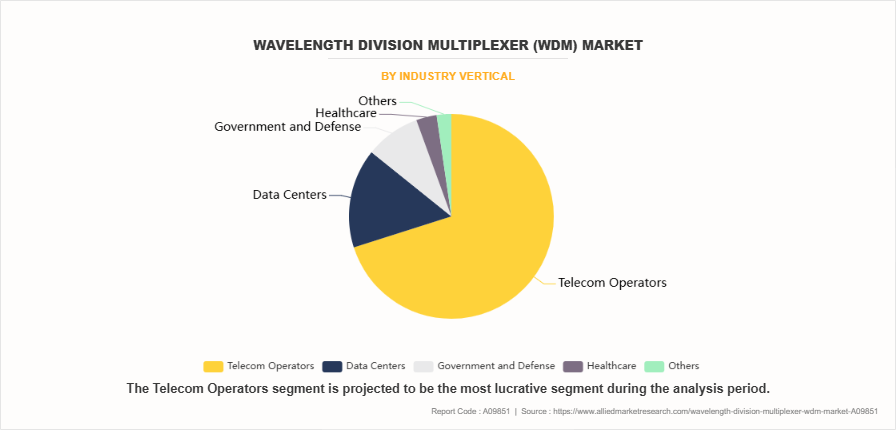

On the basis of industry vertical the Wavelength Division Multiplexer (WDM) Market Size is divided into telecom operators, data centers, government and defense, healthcare, and others.

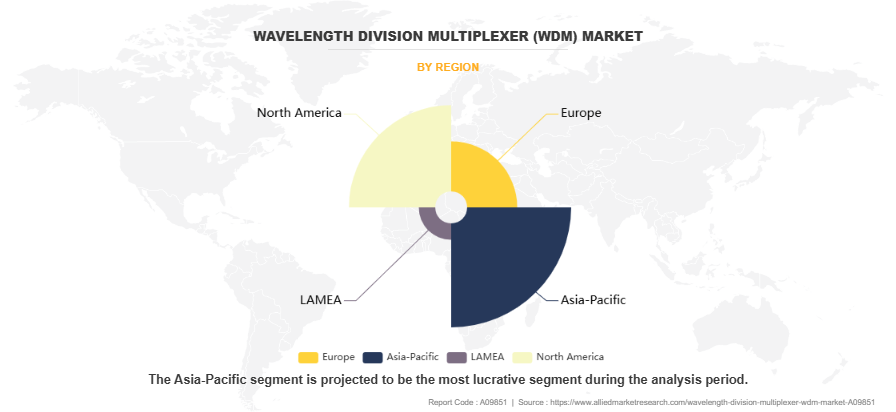

Region-wise, the wavelength division multiplexer market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Sweden, Spain, Russia, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Competition Analysis

The key players operating in the Wavelength Division Multiplexer (WDM) Industry are Ciena Corporation, Cisco System Inc., Huawei Technologies Co., Ltd., Infinera Corporation, ZTE Corporation, Nokia Corporation, FUJITSU OPTICAL COMPONENTS LIMITED, ADTRAN Holdings, Inc, ALIATHON TECHNOLOGY, and Corning Incorporated.

Key Developments/ Strategies

Ciena Corporation, Cisco System Inc., Huawei Technologies Co., Ltd., Infinera Corporation, ZTE Corporation are the top companies holding a prime share in the Wavelength division multiplexing market. Top market players have adopted various strategies, such as product launch, partnership, acquisition, Collaboration, innovation, and product development, to expand their foothold in the Wavelength division multiplexing market.

- In October 2024, PTCL Group, Pakistan's leading ICT provider, has partnered with Huawei to launch the country's first 800 Gbps per wavelength Super C+L Wavelength Division Multiplexing (WDM) system. This advanced technology enables a data transmission capacity of 64 Tbps per fiber, with the potential to reach up to 96 Tbps. The system supports a broader optical spectrum of up to 12 THz, compared to the 4.8 THz provided by traditional systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wavelength division multiplexer (wdm) market analysis from 2024 to 2034 to identify the prevailing wavelength division multiplexer (wdm) market opportunity.

- The market research is offered along with information related to Wavelength Division Multiplexer (WDM) Market key drivers, Wavelength Division Multiplexer (WDM) Marketrestraints, Wavelength Division Multiplexer (WDM) Market Forecast and Wavelength Division Multiplexer (WDM) Market opportunity.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wavelength division multiplexer (WDM) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global wavelength division multiplexer market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wavelength division multiplexer (wdm) market trends, key players, market segments, application areas, and Wavelength Division Multiplexer (WDM) Market Outlook, Wavelength Division Multiplexer (WDM) Market Growth strategies.

Wavelength Division Multiplexer (WDM) Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2034 | USD 9.7 billion |

Growth Rate | CAGR of 6.4% |

Forecast period | 2024 - 2034 |

Report Pages | 256 |

By Type |

|

By Industry Vertical |

|

By Region |

|

Key Market Players | Nokia Corporation, Ciena Corporation., Corning Incorporated, ALIATHON TECHNOLOGY, FUJITSU OPTICAL COMPONENTS LIMITED, Infinera Corporation, Cisco System Inc., Huawei Technologies Co., Ltd., ADTRAN Holdings, Inc, ZTE Corporation |

Analyst Review

According to insights from CXOs of leading optical networking companies, the global Wavelength Division Multiplexer (WDM) market holds high growth potential in the telecommunications and data networking industries. The industry landscape is experiencing an increase in demand for high-speed, high-capacity optical networks, particularly in developing countries such as India, South Korea, Argentina, Italy, and other parts of Europe and Asia-Pacific. Companies in this industry are actively implementing cutting-edge technologies such as coherent optical networking and AI-powered network automation to provide customers with superior and efficient WDM solutions.

The increasing need for high-bandwidth data transmission, driven by the expansion of 5G networks, hyperscale data centers, and cloud computing, is fueling the growth of the WDM market. The rising adoption of fiber-optic broadband and multi-terabit optical transport solutions further propels market expansion. However, high initial deployment costs and network complexity pose challenges to widespread adoption. Despite these restraints, ongoing advancements in optical networking, including photonic integration and quantum-secure communication, are expected to create lucrative opportunities for the market.

To remain competitive, market participants are introducing next-generation WDM solutions with enhanced spectral efficiency and lower power consumption. Companies are focusing on strategic collaborations, product launches, and technological innovations to strengthen their market position. For instance, in February 2023, Nokia launched its latest Photonic Service Engine (PSE-Vs), a cutting-edge optical transport solution designed for high-speed, ultra-long-haul WDM networks, improving network capacity and efficiency for telecom operators and data centers.

Related Tags

Optical FiberFiber OpticWavelength DivisionFrequently Asked Questions?

Expansion of 5G Networks, and Integration of Advanced Networking Technologies are the upcoming trends of Wavelength Division Multiplexer (WDM) Market in the globe

Telecom operators are the leading application for the Wavelength Division Multiplexer (WDM) Market

Asia-Pacific is the largest regional market for Wavelength Division Multiplexer (WDM)

In 2024, $5.3 Billion was the estimated industry size of Wavelength Division Multiplexer (WDM)

Ciena Corporation, Cisco System Inc., Huawei Technologies Co., Ltd., Infinera Corporation, ZTE Corporation, Nokia Corporation, FUJITSU OPTICAL COMPONENTS LIMITED are the top companies to hold the market share in Wavelength Division Multiplexer (WDM