Steel Casting Market

P

2025

Steel Casting Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Process, by Application : Global Opportunity Analysis and Industry Forecast, 2025-2034

Steel Casting Market Research, 2034

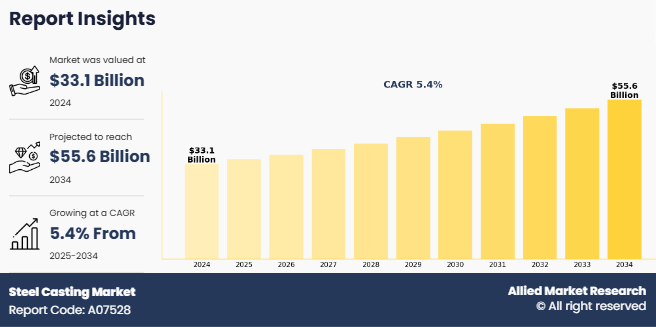

The global steel casting market size was valued at $33.1 billion in 2024, and is projected to reach $55.6 billion by 2034, growing at a CAGR of 5.4% from 2025 to 2034.

Introduction

Steel casting is a specialized form of casting that involves the use of molten steel poured into a mold to create a desired shape, which solidifies upon cooling. Steel, a versatile and high-strength alloy primarily composed of iron and carbon, is selected for casting when other materials such as iron or aluminum do not provide the required strength, toughness, or wear resistance. The process involves several key steps including pattern making, mold preparation, melting & pouring, solidification, and finishing. The casting process requires robust & sophisticated equipment and molds that withstand intense temperatures & ensure dimensional accuracy due to steel's high melting point (typically above 1400°C). Steel casting is classified into various categories, such as carbon steel casting and alloy steel casting. Carbon steel castings offer good machinability and strength, while alloy steel castings provide enhanced properties such as resistance to wear, corrosion, and heat, depending on the alloying elements used (e.g., chromium, nickel, molybdenum).

Steel casting finds widespread application in several domains owing to its adaptability and mechanical excellence. The key characteristics that make steel castings suitable across diverse sectors are their superior tensile strength, ductility, impact resistance, and fatigue resistance. These properties make steel castings indispensable in heavy-duty, high-stress applications. In the construction and civil engineering sectors, steel castings play a vital role in structural integrity. They are used in components that bear substantial loads and require high durability. Bridge components such as bearing housings, joints, and supports often utilize cast steel parts due to their ability to endure dynamic loads and environmental stress. Steel castings are used in building foundations, earthquake-resistant structures, and infrastructure such as tunnels & subways.

Key Takeaways

- The steel casting market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global steel casting market and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the steel casting market growth.

- The key players in the steel casting market are ArcelorMittal, Nippon Steel Corporation, Eagle Alloy, Jindal Steel & Power Ltd, Harrison Steel Castings Company, Ferralloy Inc, Goodwin Steel Castings., Barron Industries, WHEMCO Steel Castings, William Cook Group. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

Rise in demand for steel casting in industrial sectors is expected to drive the growth of the steel casting market in 2024. Steel casting is vital across multiple industries‐”automotive, aerospace, energy, and construction‐”due to its strength, durability, and ability to perform under extreme conditions. In the automotive sector, steel castings are essential for engine blocks, transmission parts, and suspension systems, especially as the industry seeks lightweight yet robust materials. The energy sector, including both traditional and renewable sources, depends on steel castings for critical components such as turbines, pumps, and generators, with demand rising alongside global energy needs and the shift to cleaner power. In construction, steel castings contribute to the strength and longevity of infrastructure such as bridges, building frameworks, and heavy equipment. Reflecting the growing importance of energy-related castings, Korea Western Power Co. (KOWEPO) and EDF Renewables signed a joint development agreement in March 2024 for a 1.5 GW solar project in Khazna, UAE, and are in advanced discussions for another project in Al-Ajban with Emirates Water and Electricity Co. (EWEC).

However, competition from alternative materials is expected to restrain the growth of the steel casting market. The demand for steel castings is facing increasing pressure from alternative materials, such as aluminum, composites, and polymers, particularly in industries prioritizing weight reduction and cost efficiency, such as automotive, aerospace, and consumer goods. In the automotive sector, aluminum has emerged as a strong contender due to its lightweight nature, corrosion resistance, and ability to improve fuel efficiency and extend the range of electric vehicles (EVs). Manufacturers are increasingly adopting aluminum castings for components such as engine blocks, transmissions, and body panels. Technological advancements and sustainability efforts further boost aluminum's appeal. Innovations such as low-carbon alloys, closed-loop recycling systems, and heat-treatment-free high-strength alloys (e.g., Alcoa's A210 ExtruStrong and C611 EZCast) have reduced CO2‚‚ emissions by up to 50% and cut raw material usage by 30% to 40%.

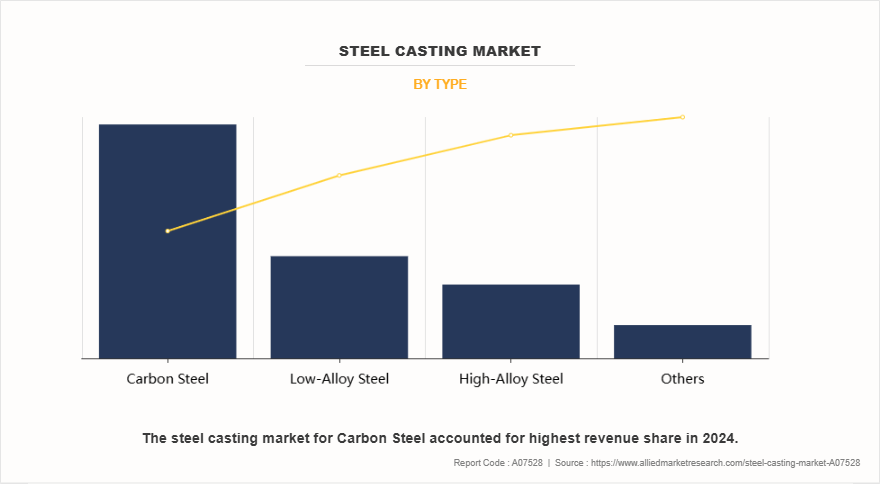

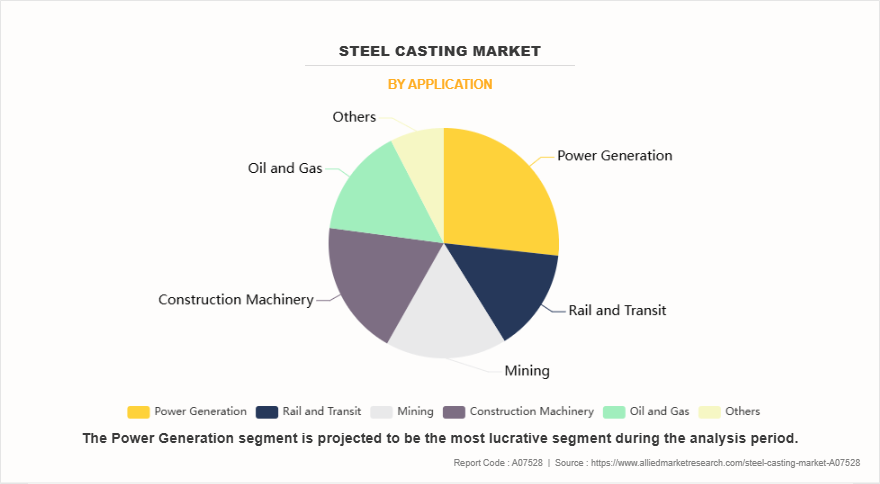

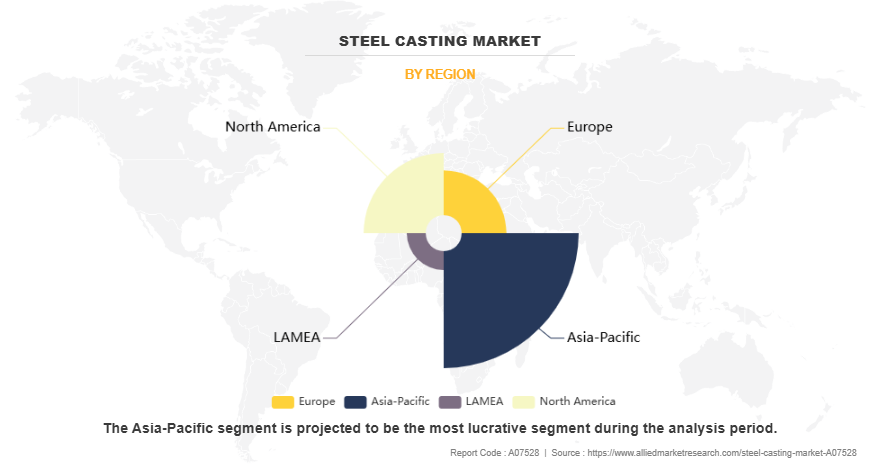

The steel casting market is segmented into type, process, application, and region. On the basis of type, the market is divided into carbon steel, low-alloy steel, high-alloy steel, and others. On the basis of process, the steel casting market is categorized into sand casting, investment casting, die casting, and others. On the basis of application, the steel casting market is classified into power generation, rail & transit, mining, construction machinery, oil & gas, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the carbon steel segment dominated the market, accounting for more than one-third of the market share in 2024. Steel casting plays a crucial role in the production and application of carbon steel across various industries. Carbon steel, composed primarily of iron and carbon, is known for its strength, hardness, and wear resistance. When manufactured through casting processes, carbon steel is shaped into complex geometries that are otherwise difficult or costly to produce using forging or machining. Steel casting allows for the economical production of large, intricate, and high-performance components, which is particularly valuable in sectors such as construction, mining, automotive, and heavy machinery manufacturing. The Ministry of Steel in India has introduced the Steel Quality Control Order (QCO), banning sub-standard and defective steel products from both domestic producers and imports. As of May 2023, 145 Indian Standards have been notified under the QCO, covering carbon steel, alloy steel, and stainless steel.

On the basis of process, the sand casting segment dominated the market in 2024. Steel casting is an essential process in the manufacturing of components that require high strength, durability, and resistance to wear and tear. In sand casting, steel is commonly used to create parts that must endure extreme conditions, such as those found in heavy machinery, automotive, and aerospace industries. The process involves pouring molten steel into a sand mold, which is created by packing sand around a pattern of the desired shape. Once the steel cools and solidifies, the mold is broken away, revealing the cast part. In January 2025, GF Casting Solutions announced plans to establish a global network of mega-casting machines across China, Europe, and the U.S. by 2026 to meet the rising demand for large structural components.

On the basis of application, the power generation segment dominated the market in 2024. Steel casting plays a crucial role in the power generation industry, particularly due to its strength, durability, and resistance to high temperatures and stress. The power generation sector relies heavily on steel castings for various components, including turbine parts, valve bodies, pumps, and structural elements in power plants. These components must endure extreme conditions, including high pressure, temperature fluctuations, and corrosive environments, all of which steel castings are well-equipped to handle. In February 2025, Australia launched $636 million fund to support the production and supply chains of green iron, with an initial A$500 million allocated to rescue the Whyalla steelworks in South Australia.

By region, Asia-Pacific dominated the steel casting market in 2024 accounting for more than one third of the market share. Steel casting is a key component across various industries in the Asia-Pacific region, driven by the region's rapid industrialization, infrastructure development, and growing demand for high-performance materials. The steel casting market in Asia-Pacific is largely influenced by sectors such as automotive, construction, power generation, and manufacturing, all of which require steel castings for producing durable, high-strength components. China, as one of the largest producers and consumers of steel, is a significant player in the steel casting industry. It has a vast manufacturing base, and steel castings are used in critical infrastructure projects such as bridges, railways, and dams. The automotive industry, which is one of the largest in the world, relies heavily on steel castings for engine components, transmission parts, and chassis.

Competitive Analysis

The major prominent players operating in the steel casting market include ArcelorMittal, Nippon Steel Corporation, Eagle Alloy, Jindal Steel & Power Ltd, Harrison Steel Castings Company, Ferralloy Inc, Goodwin Steel Castings., Barron Industries, WHEMCO Steel Castings, William Cook Group.

Recent Key Developments in Steel Casting the Market

- In January 2025, GF Casting Solutions established a global network of mega-casting machines across China, Europe, and the US by 2026 to meet the rising demand for large structural components. This network is aimed at providing customized, state-of-the-art solutions to customers worldwide, supported by the company's expertise in product and process development, as well as testing and validation.

- In March 2024, JSW Steel augmented its production capacity from 27.5 million tons to 38.5 million tons by 2024/25, with an annual investment of approximately 2.2 billion. This expansion aims to meet the escalating domestic demand for steel.

- In November 2024, GF Casting Solutions launched its innovative products at an event hosted by SERES, the maker of AITO, a notable new player in the Chinese automotive market. GF presented cutting-edge lightweighting solutions designed to reduce weight and improve the range and performance of new energy vehicles.

- In July 2022, ArcelorMittal launched R340crane rail grade steel, which is manufactured with the help of a combination of customized microalloying in the chemical composition, along with A specific rolling process and subsequent air cooling. R 340 new steel grade comes with improved hardness and mechanical properties.

- In December 2022, ArcelorMittal announced the acquisition of Riwald Recycling (Riwald), a state-of-the-art ferrous scrap metal recycling business based in the Netherlands.

Trump's Tarriff Impact on Steel Casting Industry

The tariffs have led to a substantial increase in domestic steel prices. For instance, U.S. Midwest hot-rolled coil prices surged from $728 to approximately $910 per short ton, reflecting the 25% tariff impact. Companies like Steel Dynamics reported a 39% increase in first-quarter income from steel operations, attributing this growth to the tariffs' protective effect. Similarly, Nucor and U.S. Steel have experienced heightened demand, prompting expansions in production capacity.

The U.S. tariffs have prompted steel-exporting countries to redirect their products to other markets, intensifying competition and leading to price volatility. For instance, China's Baosteel anticipates a reduction in steel exports by 15 million tons in 2025 due to rising tariffs, with indirect steel exports dropping by 20 million tons. This reallocation of exports has affected global pricing and availability of steel for casting purposes.

In India, the influx of diverted steel imports has raised concerns among domestic producers. The Indian Steel Association warned of potential market distortions and price declines due to increased imports, particularly from China. India's steel imports grew by 22% to 9.2 million tonnes in 2024, with a significant portion attributed to Chinese and Japanese shipments.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the steel casting market analysis from 2024 to 2034 to identify the prevailing steel casting market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the steel casting market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global steel casting market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global steel casting market trends, key players, market segments, application areas, and market growth strategies.

Steel Casting Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2034 | USD 55.6 billion |

Growth Rate | CAGR of 5.4% |

Forecast period | 2024 - 2034 |

Report Pages | 426 |

By Type |

|

By Process |

|

By Application |

|

By Region |

|

Key Market Players | Ferralloy Inc, Harrison Steel Castings Company, ArcelorMittal, Eagle Alloy, Barron Industries, WHEMCO Steel Castings, NIPPON STEEL CORPORATION, Jindal Steel & Power Ltd., William Cook Group, Goodwin Steel Castings |

Analyst Review

According to the opinions of various CXOs of leading companies, the increase in urbanization and infrastructure development drives the growth of steel casting market. The demand for infrastructure development is reaching unprecedented levels. Rapidly growing populations in cities are driving the need for modern infrastructure such as roads, bridges, airports, housing, and utilities. This increase in construction activity directly fuels the demand for steel castings, as steel remains a critical material for the production of construction materials, heavy machinery, and structural components. Steel casting plays an essential role in this process, providing the durability, strength, and precision required for critical infrastructure projects. On April 23, 2025, Bangladesh and the World Bank signed two financing agreements totaling $850 million. The funds are expected to support the Bay Terminal Marine Infrastructure Development Project in Chittagong and a social protection initiative targeting vulnerable populations.

However, one of the major challenges faced by the steel casting industry is the volatility of raw material prices. Steel casting relies heavily on various raw materials such as steel scrap, ferroalloys, and other metal additives to produce components that meet specific mechanical and chemical requirements. The prices of these materials can fluctuate significantly due to a variety of factors, including global supply and demand dynamics, geopolitical tensions, trade policies, and fluctuations in energy prices. This price instability can have a direct impact on the overall cost structure and profitability of casting operations. When the cost of key raw materials such as steel scrap rises, manufacturers are often left with limited options. Either they absorb the higher costs, which reduces profit margins, or they pass those costs onto customers, which can affect competitiveness in a price-sensitive market. In some cases, sudden price hikes lead to delays in production or the need to renegotiate contracts, both of which disrupt operations and damage client relationships.

Related Tags

Steel CastingSteel CastFrequently Asked Questions?

The global steel casting market was valued at $33.1 billion in 2024, and is projected to reach $55.6 billion by 2034, growing at a CAGR of 5.4% from 2025 to 2034.

The key players operating in the steel casting market include ArcelorMittal, Nippon Steel Corporation, Eagle Alloy, Jindal Steel & Power Ltd, Harrison Steel Castings Company, Ferralloy Inc, Goodwin Steel Castings., Barron Industries, WHEMCO Steel Castings, William Cook Group.

Asia-Pacific is the largest regional market for steel casting.

Power Generation is the leading application of steel casting market.

An increase in demand for additive manufacturing or 3D printing are the upcoming trends of steel casting market.