HVAC Pump Market

P

2025

HVAC Pump Market Size, Share, Competitive Landscape and Trend Analysis Report, by Pump Type, by Product Type, by End User, by Speed Control Mechanism : Global Opportunity Analysis and Industry Forecast, 2025-2034

HVAC Pump Market Research, 2034

The Global HVAC Pump Market size was valued at $36.6 billion in 2024, and is projected to reach $63.3 billion by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

An HVAC pump is a critical component in heating, ventilation, and air conditioning systems, responsible for circulating water, refrigerant, or other fluids to regulate temperature and maintain efficient climate control. These pumps are used in residential, commercial, and industrial applications, ensuring the proper distribution of heated or cooled fluids through pipes, radiators, and heat exchangers. HVAC pumps come in various types, including booster, circulation, and centrifugal pumps, each designed for specific system requirements. Moreover, advanced models incorporate variable-speed drives and smart controls to optimize energy consumption and enhance performance. Modern HVAC pumps play a crucial role in reducing operational costs and minimizing environmental impact as energy efficiency and sustainability become priorities.

For instance, in February 2025, Carrier launched the R-290 high-temperature heat pump to promote energy efficiency and sustainability in heating solutions. Designed to integrate with advanced HVAC pump technology, this innovation aims to reduce carbon emissions, optimize performance, and support the transition to environment-friendly heating systems in residential and commercial applications. Moreover, in February 2025, Viessmann Canada, a leading manufacturer of heating and renewable energy systems, launched new heat pump products for residential and light commercial applications. The Vitocal 100-S single-zone air-to-air ductless heat pump system is engineered to provide reliable comfort, even in extreme climates. Designed for energy efficiency and sustainability, this advanced heat pump integrates innovative HVAC pump technology to optimize heating and cooling performance. With its ability to maintain consistent indoor temperatures in varying weather conditions, the Vitocal 100-S supports the growing demand for high-performance, eco-friendly HVAC solutions.

HVAC pump plays a vital role in heating, ventilation, and air conditioning systems by circulating fluids such as water or refrigerant to maintain temperature control and efficient climate regulation. These pumps improve energy efficiency, enhance performance, and support sustainable HVAC operations with advanced speed controls and smart automation widely used in residential, commercial, and industrial settings.

The growing demand for energy-efficient HVAC systems is driving the growth of the HVAC pump market, as businesses and homeowners seek solutions that reduce operational costs and minimize carbon footprints. Advanced HVAC pumps with smart controls and variable-speed technology enhance performance, optimize energy consumption, and support sustainability goals, accelerating their adoption across residential, commercial, and industrial sectors. Furthermore, increase in adoption of variable-speed and smart HVAC pumps for enhanced performance and automation, and expansion of commercial and industrial infrastructure, drive the need for advanced HVAC solutions. This, in turn, drives the growth of the HVAC pump market.

However, the high initial investment and installation costs of advanced HVAC pump technologies are hampering market growth, making adoption challenging for small businesses and budget-conscious consumers. While energy-efficient pumps offer long-term savings, the upfront expenses for procurement, setup, and integration can deter potential buyers, slowing widespread implementation across various sectors. According to the HVAC pump market forecast, technical complexities and maintenance challenges in integrating smart and variable-speed pumps are also hampering the growth of the HVAC pump market

On the contrary, the rise in government initiatives and incentives for sustainable and energy-efficient HVAC solutions presents a lucrative opportunity for the HVAC pump market. Policies promoting green buildings, tax credits, and subsidies for energy-efficient systems encourage adoption, driving demand for advanced HVAC pumps that optimize performance while reducing energy consumption and environmental impact.

Segment Overview

The HVAC pump market is segmented into pump type, end user, product type, speed control mechanism, and region.

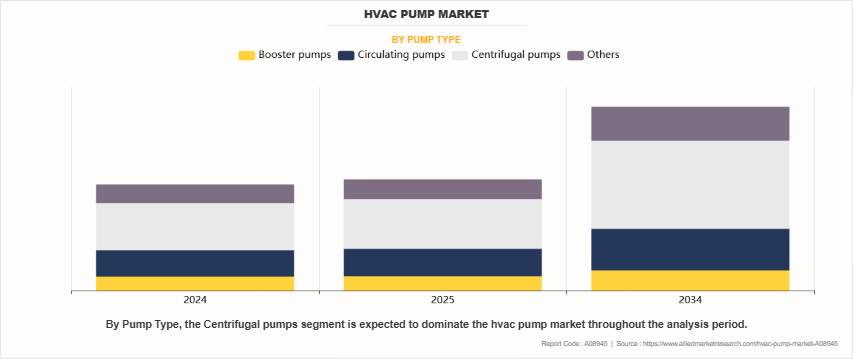

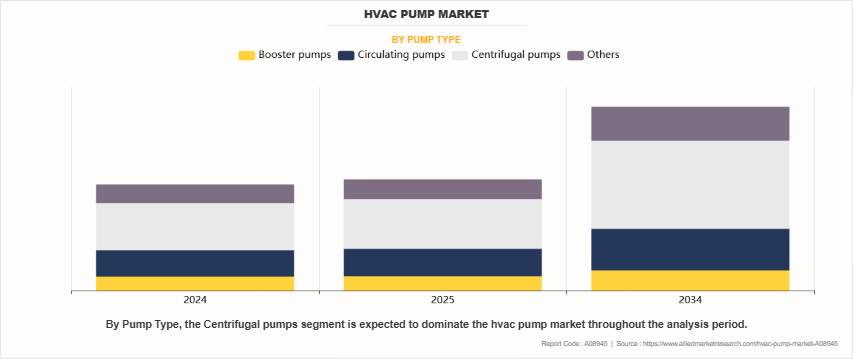

By pump type, the HVAC pump market is classified into booster pumps, circulating pumps, centrifugal pumps, and others. Centrifugal pumps hold the largest market share due to their efficiency and versatility in various HVAC applications.

On the basis of end use, the HVAC pump market is categorized into industrial, residential, and commercial. The industrial sector holds the largest HVAC pump market share, driven by the need for reliable and efficient HVAC systems in manufacturing plants, refineries, and power generation facilities.

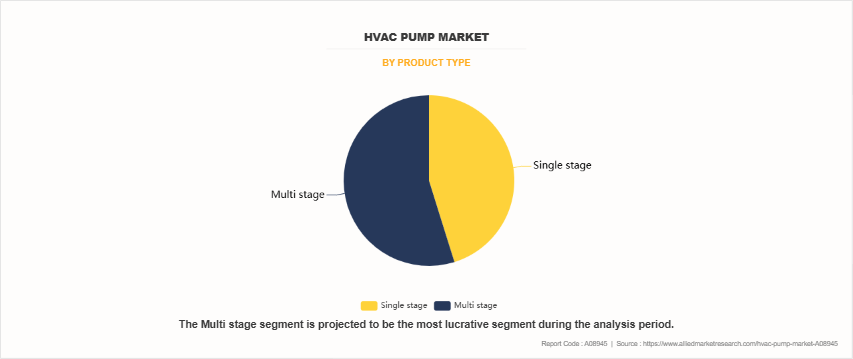

By product type, the HVAC pump market is bifurcated into single stage, and multi stage. Multi-stage pumps are preferred for their ability to handle high-pressure applications and provide consistent flow rates.

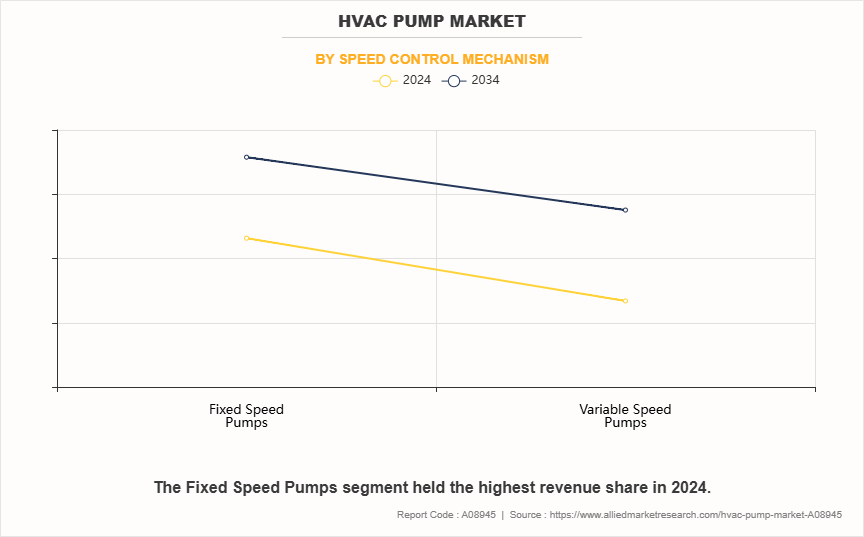

By speed control mechanism, the HVAC pump market is bifurcated into fixed speed pump, and variable speed pump. Fixed speed pumps are widely used due to their simplicity and cost-effectiveness.

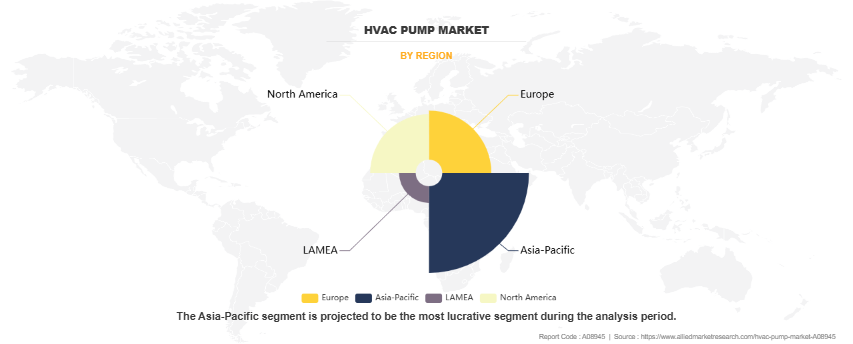

Region-wise, the HVAC pump market is studied across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region leads the market, driven by rapid urbanization, industrial growth, and increasing investments in infrastructure development, particularly in countries like China and India. Furthermore, the HVAC pump market growth across developing regions such as the Middle East and Africa has witnessed a significant surge, owing to increasing urbanization, rising investments in infrastructure projects, and the growing demand for energy-efficient HVAC systems. This growth is also supported by favorable government policies and the expansion of commercial and residential construction activities.

Competitive Analysis

The report analyzes the profiles of key players operating in the HVAC Pump such as KSB SE & Co. KGaA, Patterson Pump Company, C.R.I. Pumps Private Limited, Grundfos Holding A/S, WILO SE, KIRLOSKAR BROTHERS LIMITED, Armstrong Fluid Technology, Bard HVAC, Pentair, Xylem Inc., and Calpeda S.p.A. These players have adopted various strategies to increase their market penetration and strengthen their position in the HVAC pump market opportunity. Moreover, the HVAC pump market outlook is significantly dominated by KSB SE & Co. KGaA, Patterson Pump Company, C.R.I. Pumps Private Limited, Grundfos Holding A/S, and WILO SE,, owing to their extensive product portfolios, strong global presence, and continuous innovation in HVAC systems.

Recent Developments

- In July 2023, KIRLOSKAR BROTHERS LIMITED launched a vertical inline long coupled pump for the growing heating, ventilation, and air-conditioning (HVAC) market. The KW-LC pump is a space-saving, vertical, long-coupled design that simplifies piping and has a compact structure.

- In December 2024, Pentair acquired Florida-based G&F Manufacturing, LLC at $108 million. Through this acquisition Pentair manufactures & services heat pumps for pools under the Gulfstream brand in the Southeast portion of the U.S. This acquisition helps Pentair to boost its heat pump manufacturing production for the U.S. region.

- In August 2023, WILO SE opened a new sustainable and high-tech production plant in Kesurdi, India where it will manufacture premium pump systems for water management in India, the Middle East, Africa, and South-east Asia. The Kesurdi facility will manufacture, among other things, the WiloVertical Turbine pumps, which are up to 42 meters high and the largest products in the Wilo portfolio.

- In May 2023, Xylem Inc. partnered with Tiba Manzalawi Group to open a manufacturing site, the Xylem Egypt Plant at Egypt. The Xylem Egypt Plant initially manufactured Split-Case Centrifugal pumps for different applications such as irrigation, HVAC, and commercial building services, and EndSuction pumps for industry and irrigation.

- InJune 2024, Armstrong Fluid Technology opened 29,000-square foot industrial heat-pump manufacturing wing at its Three Rivers, Michigan, campus, U.S. The project is supported through a grant of just over $5 million from the U.S. Department of Energy (DOE). The grant enables Armstrong to significantly bolster its manufacturing capabilities,specifically to produce specialized industrial heat pumps designed for applicationsthat require more than 100 kW of heat and temperatures above 180°F.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the HVAC pump market analysis from 2024 to 2034 to identify the prevailing HVAC pump industry opportunities.

- The HVAC pump industry research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the HVAC pump market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global HVAC pump market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global HVAC pump market trends, key players, market segments, application areas, and market growth strategies.

HVAC Pump Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2034 | USD 63.3 billion |

Growth Rate | CAGR of 5.7% |

Forecast period | 2024 - 2034 |

Report Pages | 348 |

By Pump Type |

|

By End User |

|

By Product Type |

|

By Speed Control Mechanism |

|

By Region |

|

Key Market Players | WILO SE, Grundfos Holding A/S, Xylem Inc., KIRLOSKAR BROTHERS LIMITED, Bard HVAC, KSB SE & Co. KGaA, Armstrong Fluid Technology, Patterson Pump Company, Pentair, Calpeda S.p.A., C.R.I. Pumps Private Limited |

Analyst Review

As per CXO perspective, the HVAC pump market is experiencing significant growth, driven by increase in demand for energy-efficient heating, ventilation, and air conditioning solutions across residential, commercial, and industrial sectors. The rise in emphasis on sustainability and the transition to eco-friendly refrigerants have led to the adoption of advanced pump technologies, particularly variable-speed pumps, which optimize energy consumption and enhance system performance. Additionally, the growing focus on smart building infrastructure and automation has further accelerated the integration of intelligent pump systems that enable remote monitoring, predictive maintenance, and improved operational efficiency. For instance, in August 2023, Johnson Controls expanded its smart building technologies by integrating intelligent automation and energy-efficient HVAC pump solutions. With a focus on variable-speed and smart pumps, the company enhances performance, reduces energy consumption, and supports sustainability goals. Its innovations align with global efforts to lower carbon emissions, reinforcing its leadership in energy-efficient infrastructure.

Moreover, government regulations and incentives promoting energy-efficient HVAC systems have also played a crucial role in market expansion. Various nations are implementing stringent policies to reduce carbon footprints, pushing HVAC manufacturers to innovate and develop high-performance pumps that comply with environmental standards. The increase in penetration of district heating and cooling systems, particularly in urban areas, has further boosted demand for HVAC pumps. For instance, in January 2025, AAON and other OEMs partnered with Copeland to develop cold-climate heat pump solutions, supporting urban energy efficiency. Aligned with DOE technology challenges, these innovations enhance heating performance, reduce carbon footprints, and optimize climate control in dense residential and commercial buildings, ensuring cost-effective and sustainable HVAC solutions for growing urban areas.

Rapid urbanization and industrialization in emerging economies, particularly in the Asia-Pacific region, are driving the need for advanced HVAC infrastructure, contributing to market expansion. In additon, technological advancements in pump design, such as the use of IoT and AI-driven controls, are reshaping the industry by enhancing operational reliability and reducing maintenance costs. The HVAC pump market is poised for sustained growth, offering lucrative opportunities for manufacturers and suppliers worldwide with the growing adoption of energy-efficient and smart HVAC solutions.

Some of the key players profiled in the report include KSB SE & Co. KGaA, Patterson Pump Company, C.R.I. Pumps Private Limited, Grundfos Holding A/S, WILO SE, KIRLOSKAR BROTHERS LIMITED, Armstrong Fluid Technology, Bard HVAC, Pentair, Xylem Inc., and Calpeda S.p.A. These players have adopted various strategies to increase their market penetration and strengthen their position in the HVAC pump market.

Related Tags

Building automationSmart pumpCommercial HVACHVACFrequently Asked Questions?

Asia-Pacific is the largest regional market for HVAC Pump.

The HVAC pump market is expected to see several key trends in the coming years. These include the increased adoption of smart HVAC systems that integrate with the Internet of Things (IoT) for better control and efficiency

The HVAC pump market was valued at $36,559.9 million in 2024.

The industrial segment is the leading application of the HVAC Pump Market.

The top three companies holding significant market share in the HVAC pump market are Grundfos, Wilo SE, and KSB Limited.