Camping And Caravanning Market

P

2023

Camping And Caravanning Market Size, Share, Competitive Landscape and Trend Analysis Report, by Destination Type, by Type of Camper, by Consumer Orientation, by Age : Global Opportunity Analysis and Industry Forecast, 2021-2031

The global camping and caravanning market was valued at $42.4 billion in 2021 and is projected to reach $87.7 billion by 2031, growing at a CAGR of 7.7% from 2022 to 2031.

The camping and caravanning market is pacing rapidly globally owing to growing awareness of eco-camping to practice environment-friendly camping activities. This includes renewable electricity utilities, reusable utensils, cutlery, and others. Further, the young generation inclining towards exploring adventure and wildlife tourism due to which the camping and caravanning industry is expected to propel in the forecast period.

The rising number of tourists is another factor supplementing the market. In 2021, more than 93.8 million North American households considered themselves campers. Caravan parks importantly supply the most broad, varied, and affordable tourism accommodation offerings in the country. Similarly, the caravan and camping industry has consistently remained the biggest domestic tourism sector and for the year ending September 2021, more than 12.8 million caravan and camping trips and over 52.1 million nights were recorded across Australia.

Further, the increasing spending of a governmental organization to boost the travel & tourism industry, and rising disposable income, are some of the prominent factors responsible for the market growth. Apart from this, various travel and tourism regulatory authorities are proficiently emphasizing on promoting and forming sustainable camping and caravanning policies to boost the economic condition of the countries and promote environmentally friendly travel. This is a major contributor to market growth.

Despite the above driving factors, the market is expected to limit in the coming years owing to the involvement of non-governmental bodies (NGO) that restrict tourists to campsites. This is mainly due to improper waste management, activities like the use of barbecue facilities in the open that can cause accidental fires in parks and camps, and negligence in following guideline to prevent injuries, loss of life, and loss of property in fires in on camping sites.

Other reasons responsible for influencing the expansion of the camping and caravanning sector mainly include the enhancement of lifestyle, highlighting culture, and vacation in style and luxury are other factors. Moreover, a rise in sales of recreational vehicles is recognized as an emerging trend in the market. Recreational vehicles (RVs) present a large opportunity for PV in the U.S. market. According to the RV Industry Association, the total RV shipments for 2021 ended with a record of over 600,000 wholesale shipments.

Similarly, the prominent players are investing massively in exploring advanced RV vehicles to create a strong business segment that endures businesses to sustain their presence in the global market. Apart from this, industry players are adopting various expansion strategies that include product launches, mergers & acquisitions, collaborations, and partnerships. These strategies enable manufacturers to expand their geographical presence in the global market. For instance, In October 2022, MharoKhet, an experiential farm, is collaborating with RV On, India’s leading caravan company, all set to take visitors to its fields in a luxury ride for a tranquil caravan camping experience.

The key players profiled in this report include Discovery Parks Private Limited, European Camping Group, Kampgrounds Of America, Inc., Parkdean Holidays Limited, Equity Lifestyle Properties, Sun Communities, Bourne Leisure, The Camping and Caravanning Club, Drayton Manor, La Bella Vista, Altmark.de.

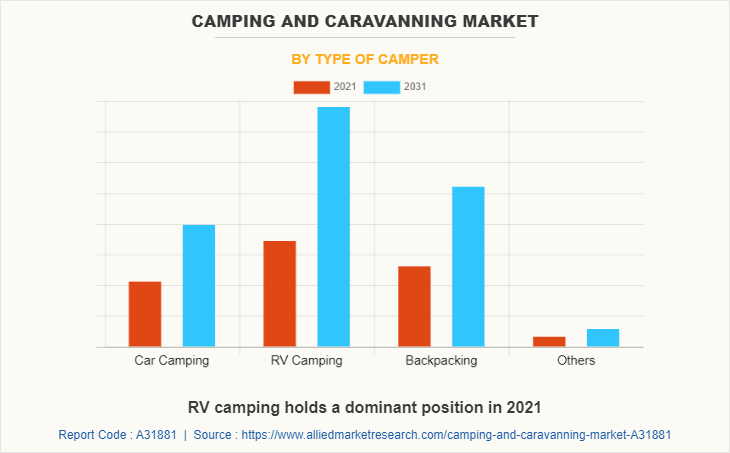

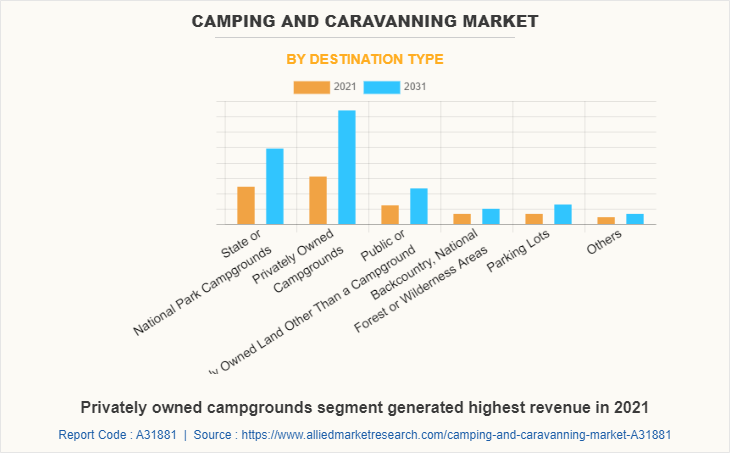

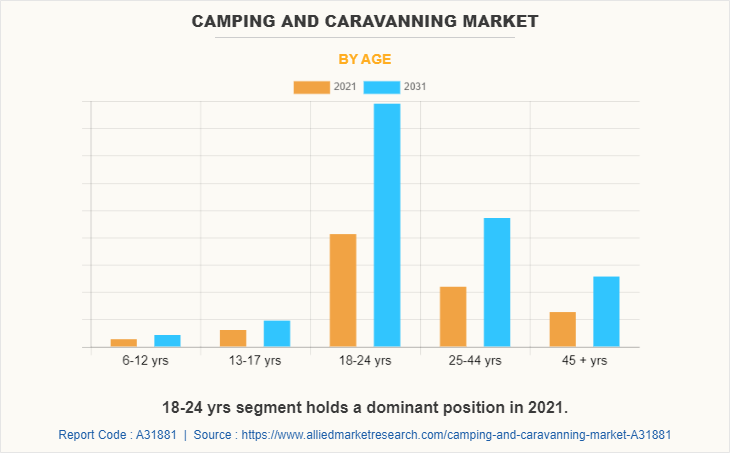

The global camping and caravanning market is segmented on the basis of destination type, type of camper, consumer orientation, age, and region. By destination type, the market is divided into state or national park campgrounds, privately owned campgrounds, public or privately owned land other than a campground, backcountry, national forest or wilderness areas, parking lots, and others. By type of camper, the market is divided into car camping, RV camping, backpacking, and others. by consumer orientation, the market is divided into adult males, adult females, and kids. By age, the market is categorized into 6-12 yrs, 13-17 yrs, 18-24 yrs, 25-44 yrs, and 45 + yrs. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The camping and caravanning market is segmented into Type of Camper, Destination Type, Age, and Consumer Orientation.

By type of camper, the RV camping sub-segment dominated the global Camping and caravanning market share in 2021. Recreational vehicles are fueling rapidly owing to the rising tourism industry, rising interest of the young and aging generation to explore camping sites, and adventure locations across different geographies are the major factors responsible for increasing the penetration of RV vehicles. Further, advanced technological advancement in recreational vehicles is further responsible for market growth.

By destination type, the privately owned campgrounds sub-segment dominated the market in 2021. Privately owned campgrounds are majorly increasing owing to millennial campers rising rapidly across the globe. Further, rising tourism businesses in developed and developing countries are proving to be a potential factor responsible for boosting this segment. These are predicted to be the major factors fueling the Camping and caravanning market size.

By age, the 18-24 sub-segment dominated the global Camping and caravanning market share in 2021. The 18-24 age are majorly millennials and the young population that are interested in exploring new adventurous places and destinations. Moreover, these age consumers are adopting environmentally friendly camping activities that are together responsible for fueling the camping and caravanning market demand.

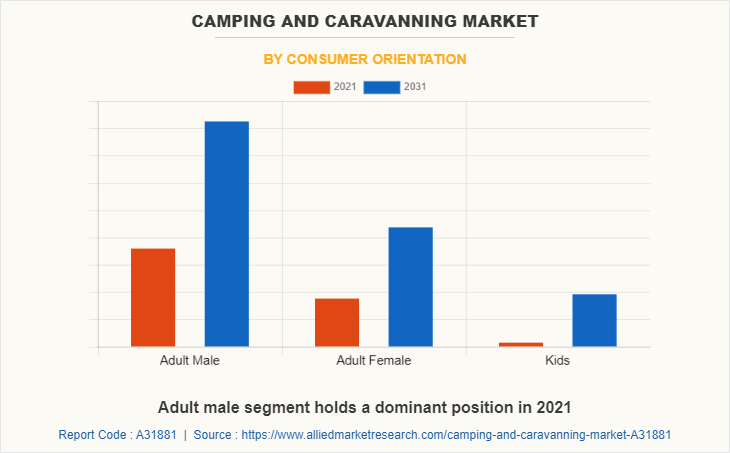

By consumer orientation, the adult male sub-segment dominated the global Camping and caravanning market share in 2021. The adult male prefers outdoor campervans or campsite stays. Further, the male is more inclined towards adventurous and wildlife sites. Also, according to secondary sources, a total of 49% of adult respondents indicated they generally made the arrangements to go caravan and camping by themselves out of which 55% of males initiate travel and are considerably more involved in the overall purchase process and handle the travel.

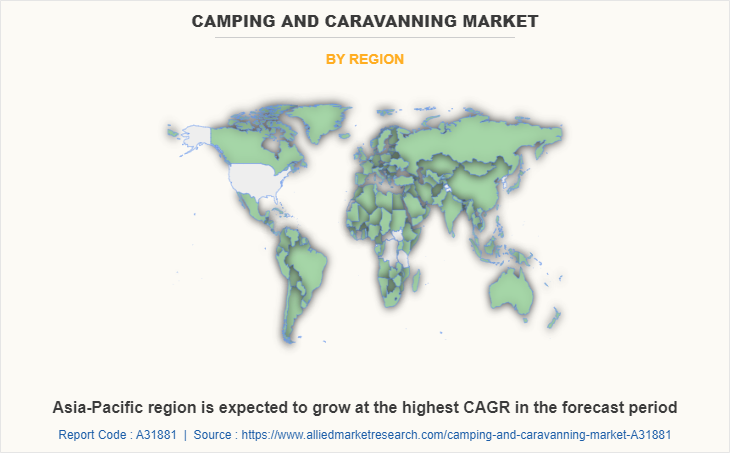

By region, North America dominated the global Camping and caravanning market in 2021. The dominance of this region can be attributed to increasing government spending to build the travel and tourism industry. Further, the rising penetration of electric RV vehicles wherein the integration of tracking software is rapidly surging. This factor is likely to fuel the Camping and caravanning market in the coming years. Moreover, stringent regulatory norms to promote sustainable travel and eco-friendly camping are some of the other major factors boosting the camping and caravanning market growth.

Impact of COVID-19 on the Global Camping and caravanning Industry

- COVID-19 has negatively impacted various industries such as automotive that has led to a drastic decline in automotive sales. As Camping and caravanning are a part of the travel and tourism industry, there was a significant reduction in the camping and caravanning demand globally.

- The COVID-19 pandemic has brought several uncertainties leading to severe economic losses as various businesses across the world were standstill. This has ultimately lowered the demand for camping and caravanning due to sealed cross borders, social distancing norms, and a complete shutdown of travel & tourism agents and companies.

- Moreover, the sales of RV vehicles were dramatically reduced due to the sudden lockdown worldwide. Imbalance in the supply chain ecosystem, volatility in raw material prices, components unavailability, and other factors. Moreover, the automobile industry faced difficulties in terms of a lack of skilled and unskilled professionals, trade imbalances, and stringent cross border policies limiting the camping and caravanning market forecast.

- Lastly, the safety and travel restrictions protocol hampered the travel and tourism industry to a greater extent.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the camping and caravanning market analysis from 2021 to 2031 to identify the prevailing camping and caravanning market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the camping and caravanning market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global camping and caravanning market trends, key players, market segments, application areas, and market growth strategies.

Camping And Caravanning Market Report Highlights

| Aspect | Details |

|---|---|

Market Size By 2031 | USD 87.7 billion |

Growth Rate | CAGR of 7.7% |

Forecast period | 2021 - 2031 |

Report Pages | 280 |

By Type of Camper |

|

By Destination Type |

|

By Age |

|

By Consumer Orientation |

|

By Region |

|

Key Market Players | Equity Lifestyle Properties, Inc., The Golden Nugget RV Park, european camping group, BTG Group, Jellystone Park, Kampgrounds Of America, Inc., Bourne Leisure Holdings Limited, Ellevacanze, Fallen Rock RV Parke & Campground, Normandy Farms |

Analyst Review

The camping and caravanning industry is likely to experience robust growth in the coming years owing to rising popularity of wildlife and other adventure tourism. Further, rising disposable income, cooperation of governmental bodies to develop infrastructure and services for camping and caravan segment are some of the potential factors boosting the market. Additionally, the rise in sales of leisure vehicles in regions mainly North America, Europe, Oceania, and other geographies are together supplementing the market growth. However, involvement of non-governmental organization (NGO) to limit outdoor recreational activities to avoid accidental fires in parks and camping sites are some of the reasons limiting this industry. Moreover, introduction of eco camping which emits lower carbon emissions, utilities renewable electricity supplies getting tractions amongst young generation and millennials is creating lucrative business opportunities resulting in growth of camping caravanning market. Furthermore, introduction of advanced intuitive technologies embedded in leisure vehicles enhancing tourism travelling experiences are the major trends likely to fuel the industry in the forecast period

Among the analyzed regions, North America is expected to accounted for the highest revenue in the market by the end of 2031, followed by Europe, Asia-Pacific and LAMEA.

Related Tags

Travel Destinations Luxury Accommodations Travel Packages Adventure Travel Travel Experiences Adventure Destinations Sustainable Travel Travel RetailFrequently Asked Questions?

The rising tourism and travel industry across the globe is a major factor responsible for market growth. Further, rising disposable income, favourable regulatory & governmental policies to boost camping industry. Moreover, emergence of new adventure and wildlife spots are boosting the market.

The major growth strategies adopted by camping and caravanning market players are acquiring small & medium sized travel and tourism players to expand its geographical reach.

ACCOR SA, Hilton Worldwide Holdings Inc., International Palamos, Radisson Hotel Group, HIP camp, Selectcamp, Vacansoliel, ACSI Holding BV are the major players in the camping and caravanning market.

Travel and tourism industry leaders are the major the major customers in the global camping and caravanning market.

Privately owned campgrounds sub-segment of the destination type acquired the maximum share of the global camping and caravanning market in 2021.

Asia-Pacific will provide more business opportunities for the global camping and caravanning market in future.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global camping and caravanning market from 2021 to 2031 to determine the prevailing opportunities.

The use of camping and caravanning RV vehicles are the major trends that are expected to boost the industry in the forecast period.